Beyond The Payslip: How Employee Self-Service Transforms Payroll Management

Paysquare

MARCH 3, 2024

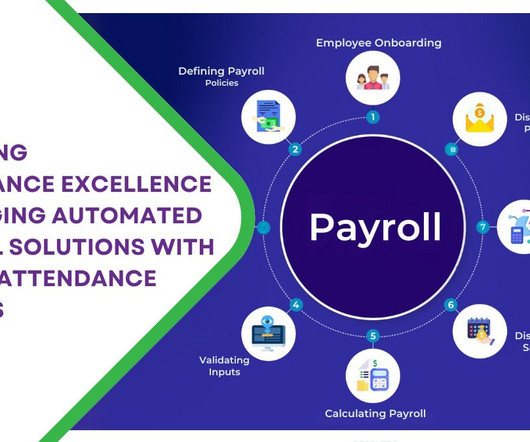

Traditional payroll management systems are known for using manual processes and paperwork, which only lead to increased tasks. In these systems, payroll administrators were responsible for calculating wages, taxes, and deductions. They often used spreadsheets or outdated software to perform the tasks.

Let's personalize your content