6 Reasons Financial Institutions Are Embracing Risk and Regulation Tactics

Perficient Digital Transformation

DECEMBER 18, 2023

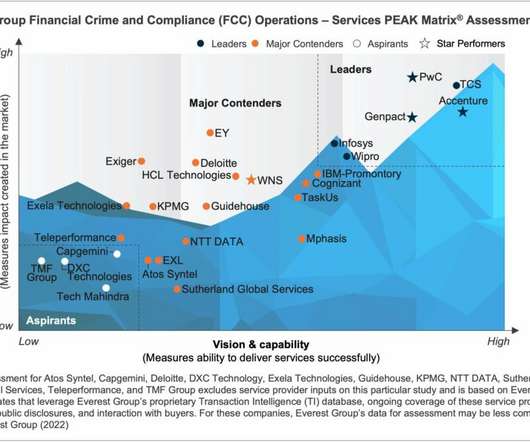

This blog post delves into the pivotal role these practices play in ensuring the stability and success of financial institutions and banks. Legal Obligations and Regulatory Frameworks It is well-known that financial institutions operate within a complex web of laws and regulations. The Role of Regulatory Risk and Compliance 1.

Let's personalize your content