The Role of Outsourced Payroll in Cost Savings for Businesses

Paysquare

JUNE 30, 2023

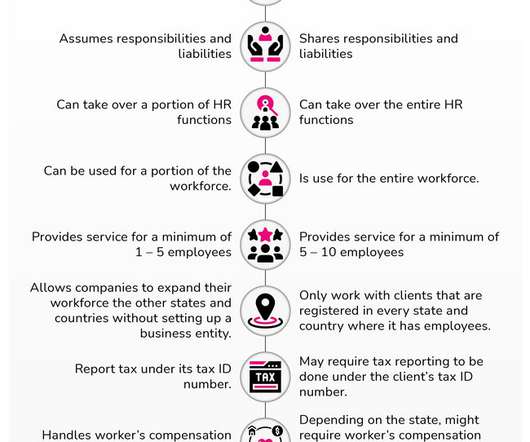

Every business or company regardless of size needs to have a payroll system in place. Payroll management, however, may be a time-consuming and challenging chore for organizations that diverts attention from other crucial business operations. Thus, Outsourcing payroll help in this situation. It is also expensive.

Let's personalize your content