Decoding the EU AI Act: What it Means for Financial Services Firms | Blog

Everest Group

MAY 24, 2024

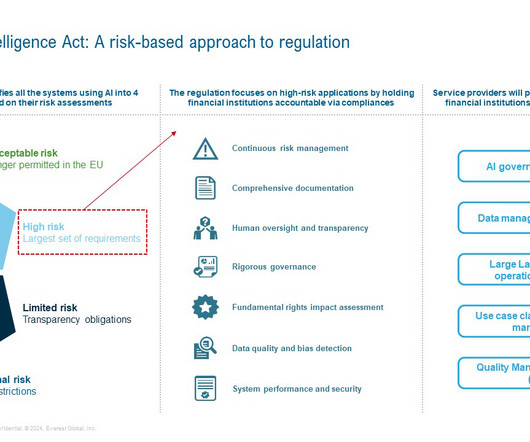

How will the EU AI Act impact the financial services sector, and how should enterprises and service providers structure their compliance activities? First, they should develop a comprehensive compliance framework to manage AI risks, ensure adherence to the Act, and implement risk mitigation strategies.

Let's personalize your content