Ensuring Banking Compliance Through Project Management Expertise

Perficient Digital Transformation

APRIL 8, 2024

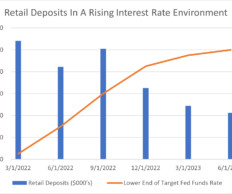

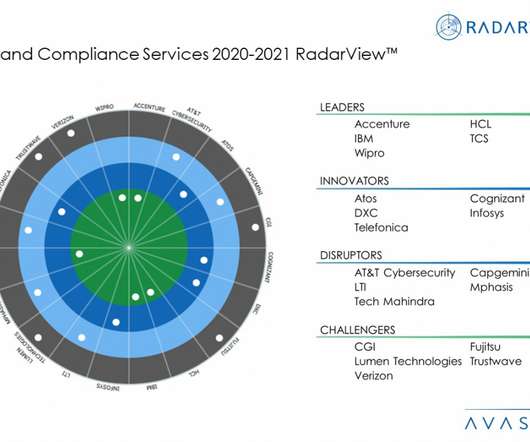

A top-leading bank, grappling with business and regulatory challenges, faced scrutiny after failing the Federal Reserve’s annual stress test. To bolster its capabilities and ensure compliance, the bank sought assistance from Perficient in delivering exceptional project and program management services to tackle their significant hurdles.

Let's personalize your content