Unlocking Enterprise Preparedness for T+1 Settlement: The Crucial Role of IT and Technology Services Providers | Blog

Everest Group

MARCH 19, 2024

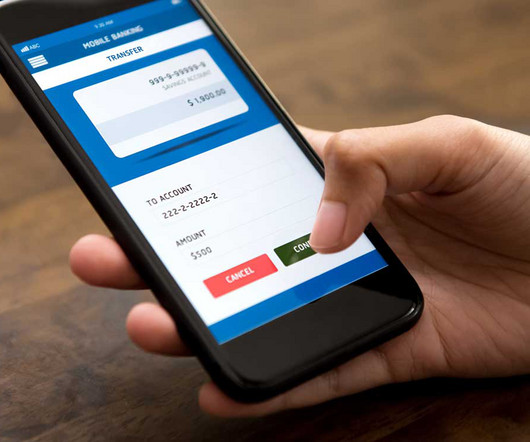

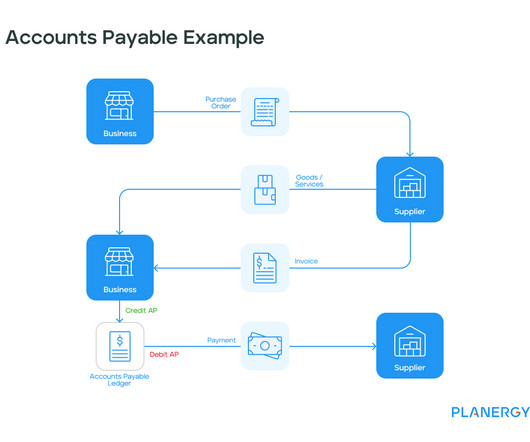

By partnering with IT and technology services providers, banks and financial institutions can prepare for the new T+1 settlement. This security trade rule change to shorten the order finalization date by a day is expected to enhance operational efficiencies and reduce risk. Let’s explore its ramifications further.

Let's personalize your content