How to Handle Payroll Challenges with Ease Using These Top 12 Tips

Paysquare

MAY 27, 2023

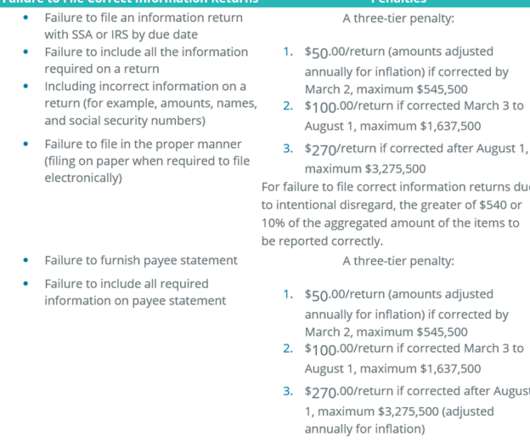

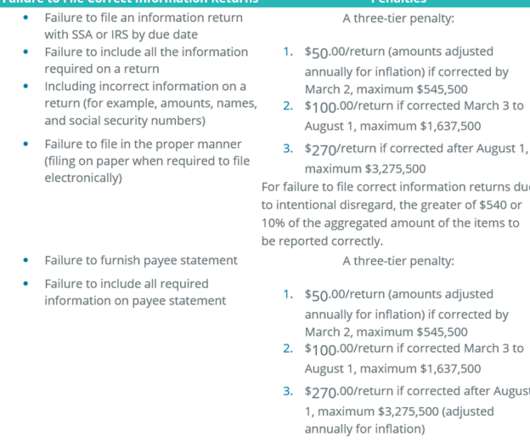

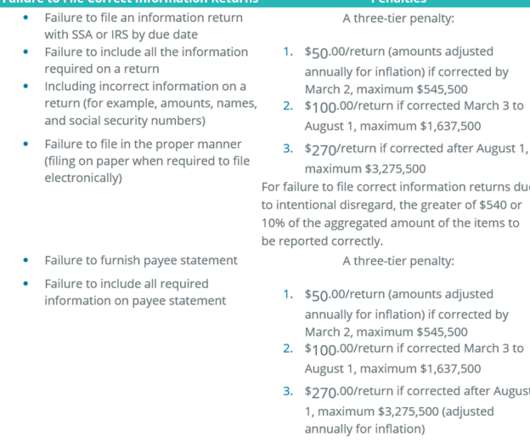

Untimely filing of taxes, not getting accounts audited, non-compliance with TDS regulations, and wilfully evading tax can lead to penalties and imprisonment. Both payroll and HR departments are co-dependant on each other and their functions are crucial for successful business. You should consider relocating their payroll duties.

Let's personalize your content