Our inaugural Forces & Foresight™ research uncovers three factors we predict will drive a gradual recovery in tech services this calendar year. Continue reading to understand the projected path for the IT services industry’s rebound and implications for providers.

Learn more about Forces & Foresight™.

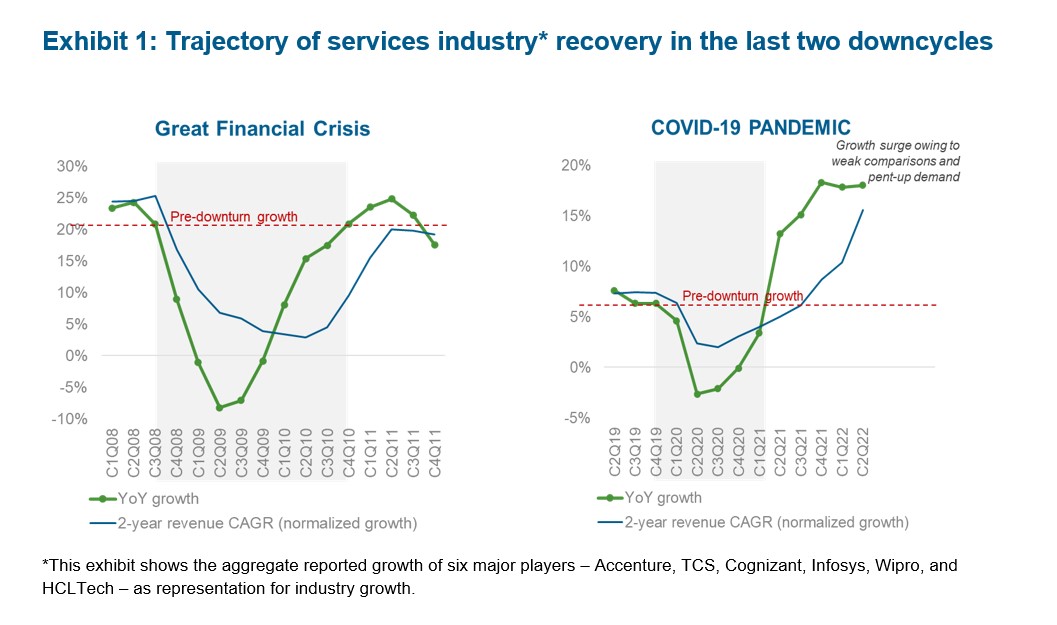

After the global financial crisis in 2008 and the COVID-19 pandemic in 2020, the IT services industry took five to eight quarters to recover. Both recessions had specific catalysts, and the IT services growth rebound after each downturn was fueled by weak comparisons and a release of significant pent-up demand (as illustrated in Exhibit 1).

Let’s explore whether the current economic decline will follow a similar trajectory based on Forces & Foresight™ research that dives deep into comprehensive dynamics to understand the industry implications.

Over the past year, the contrasts between past recessions and ongoing macro challenges have been well-researched and discussed. More importantly, the industry is now facing multiple forecasts – pulling in different directions – on how the broader macroeconomic outlook will impact IT services growth.

The following three factors are fueling our foresight:

- Stabilizing base

Despite the uncertainty that has impacted enterprise decision-making for the past several quarters, we now see signs of spending stability. The fundamental need to leverage technology for growth or cost is keeping enterprise IT budgets green.

Some examples of various factors that give us confidence the demand downtrend has at least stabilized include:

-

- Enterprises: Everest Group’s Key Issues Study of enterprise priorities captured that over 60% of enterprises (from a sample of 200-plus) plan to increase technology budgets in 2024

- IT Providers: A notable trend for technology platform players’ performance and outlook is that SaaS/PaaS players are not only reporting double-digit growth and new clients but also foresee growth continuing in 2024

- Services: We see strong resilience for IT services spending in specific segments such as public sector, healthcare, and energy

- Fixing revenue leakage

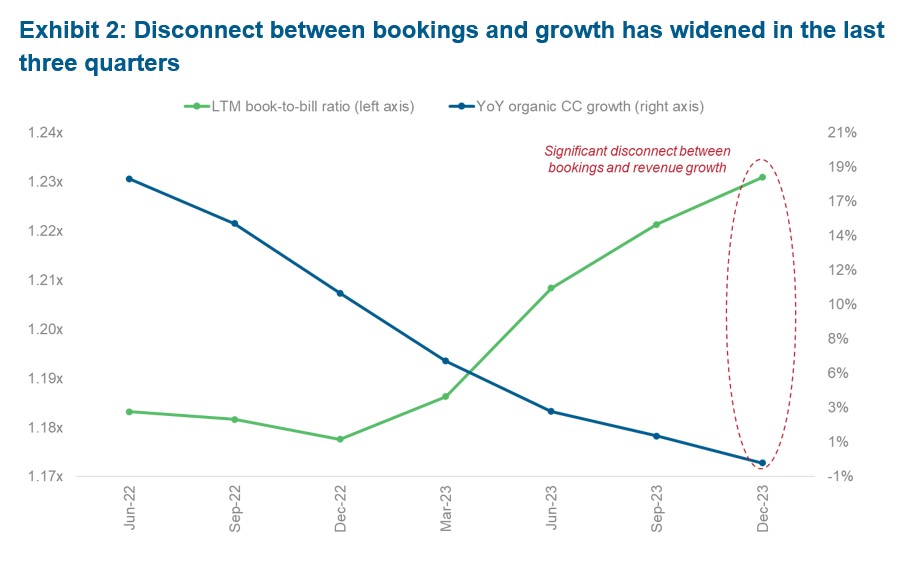

Over several past quarters, service providers have reported contradictory numbers for revenue growth versus bookings (Exhibit 2).

Our research uncovered some key factors creating this dichotomy, including shifting profiles of existing deals to longer terms and lower annual contract values (ACVs), delayed/canceled commitments, and slow ramp-ups of large deals.

As a result, signings did not translate into revenue growth even after expected ramp-up periods. However, we see signs of stabilization in the latest quarter, especially for mid-tier players, and some stalled projects moving forward. This signals that the net negative effect is reversing and that net positive revenue contribution from bookings may begin.

- Pockets of additional demand

We see some specific growth areas in 2024. Rising cybersecurity demand is promising (as is the case in challenging periods) and is seeing more takers, such as governments expanding cybersecurity budgets. Engineering, Research, and Development (ER&D) demand in asset-heavy industries like automotive is getting stronger as enterprises strategically invest in next-generation concepts to modernize, such as smart factories. Data and analytics will continue its growth trajectory, with the rise in Artificial Intelligence (AI) fueling more robust use cases.

Beyond these promising areas, we also see signs of a turnaround in segments and sub-segments that were hit hard in recent quarters. Prominent ones include investment banking and high-tech industries, and North America.

Note: We are not factoring in benefits from AI and generative AI (gen AI) in our foresight for 2024. While we strongly believe in the immense potential of gen AI, our research suggests that scaled adoption will still take time, and the effect on this year’s growth will not move the needle.

Implications for service providers

Despite the ongoing challenges, the industry has not slumped. The revenue declines seen in one to two quarters is better than several quarters in previous downturns (Exhibit 3). We predict pivotal growth soon.

However, given the “classical economics” nature of this downturn impacting IT services, we anticipate the industry’s recovery will be more gradual than previous event-based downturns, in contrast to the sharp recovery in the last two recessions. We expect a diverse mix of industry verticals and geographies to undergo various recovery cycles, making it an interesting and complex scenario.

The key for IT service providers lies in identifying early recovery pockets and attacking rather than being defensive and possibly investing in account management on late recovery cycle areas.

For more insights, supporting data, and trends on IT services growth, please read the report, Forces & Foresight Q1 2024.

Contact Prashant Shukla to learn more at [email protected].