What Is Excise Tax? All You Need to Know for Tax Season

inDinero

JANUARY 29, 2024

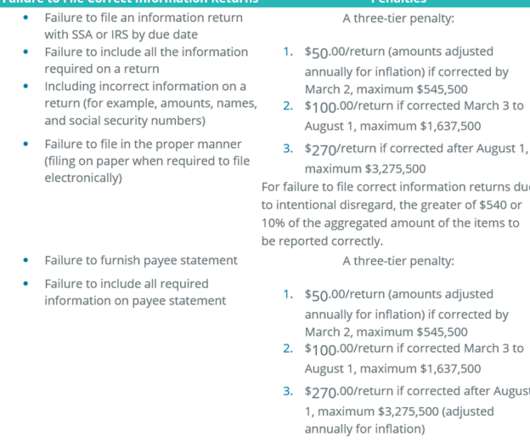

In contrast to sales tax, levied on nearly everything and paid directly by the consumer, excise tax is applied only to certain goods and is paid by the merchant. Although entrepreneurs prefer to focus on generating revenue, excise tax is one of the many details business owners must understand to run a successful operation.

Let's personalize your content