Revolutionizing Risk: Exploring Actuarial Outsourcing in Insurance | Blog

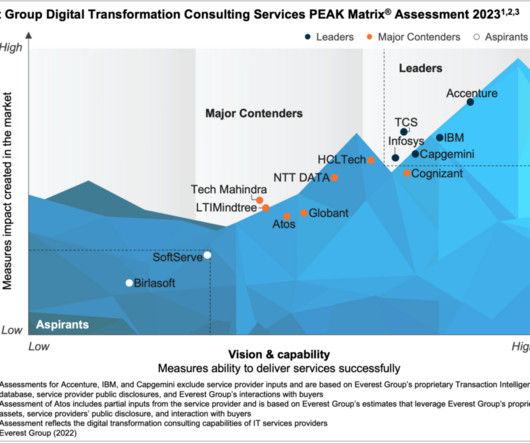

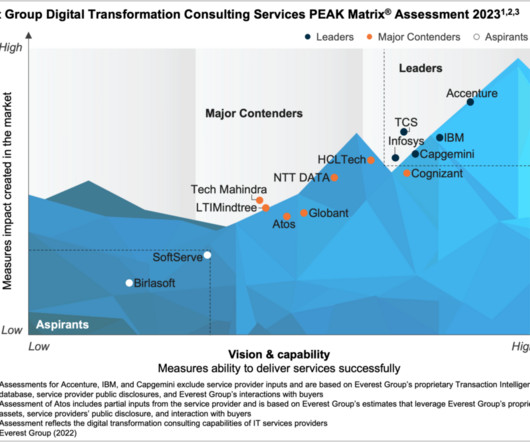

Everest Group

MAY 21, 2024

Outsourcing is a growing trend in the insurance industry to transform the actuarial function by reducing costs, creating innovation, increasing efficiencies, and filling the talent demand. Explore the factors driving insurers to partner with specialized service providers and the advantages and obstacles of actuarial outsourcing.

Let's personalize your content