Understanding School Budgets

A school budget is more than just a financial document. It’s a strategic tool that maps out the allocation of resources over a specified period, typically a school year.

With a well-planned budget, schools can anticipate revenues, plan for expenditures, and analyze whether there are enough funds to cover operational needs and educational programs for the upcoming financial year.

For instance, a school may allocate part of its budget to improve its science labs to enhance students’ learning experiences.

This decision would be reflected in the budget, showing how much funding will be directed towards this project.

The Significance of Budget Management in Schools

Budget management is the beating heart of every school administration. It ensures transparency, aids decision-making, and enables schools to allocate resources where needed.

Effective budget planning and management prepares schools for financial uncertainties and helps manage risks.

For example, if a school has a robust financial management system in place, it can better handle unexpected situations by budgeting for these variable expenses.

Sudden maintenance or repair work or the need for additional staffing costs due to long term sick leave are likely realities for schools that need to be factored into the budget.

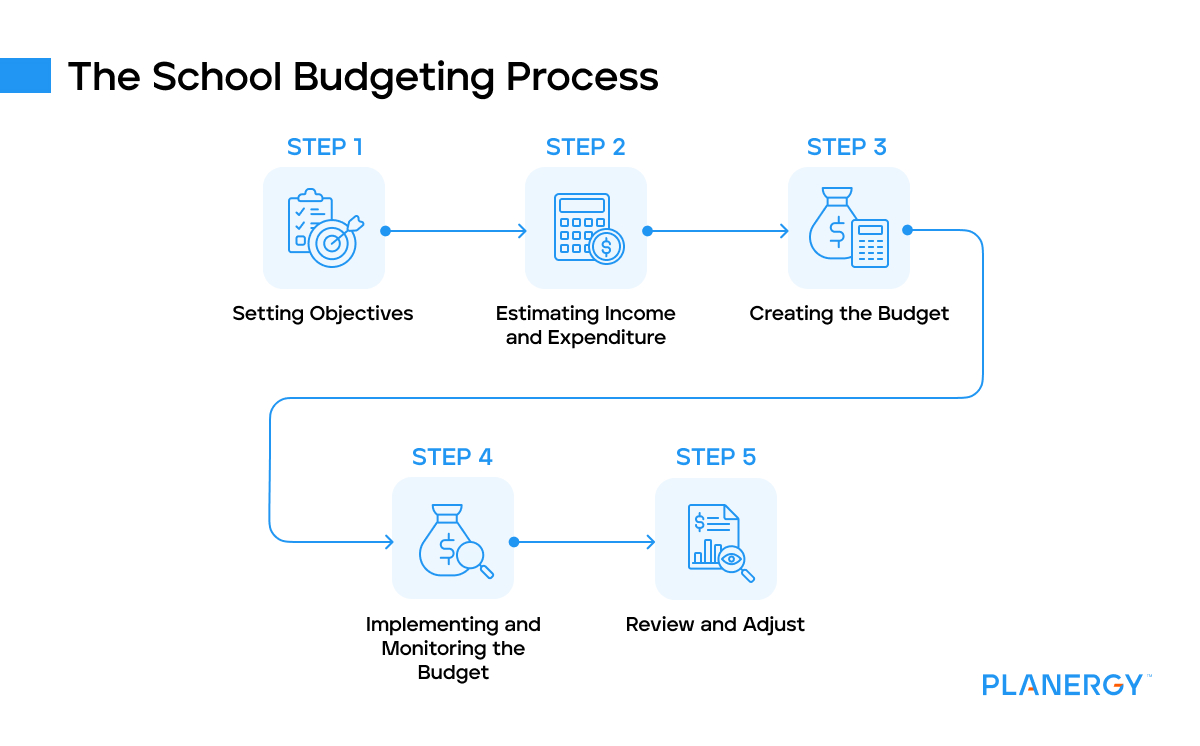

The School Budgeting Process

The budgeting process in schools works similarly to any business budget. Creating a school budget is a meticulous process that involves several steps:

Setting Objectives

This foundational stage involves identifying what the school aims to achieve, from enhancing student services to upgrading facilities or investing in professional development for staff.

These objectives should align with the school’s mission and long-term strategic plan.

For instance, if a school’s mission is to provide a holistic education, an objective could be to allocate funds toward expanding arts programs or sports facilities.

Estimating Income and Expenditure

On the income side, this includes predicting revenues from various sources such as government funding (dedicated schools grants, for instance), donations, and fundraising activities.

On the expenditure side, schools must forecast their expenses, including salaries, maintenance costs, supplies, and capital expenditures.

This step requires careful consideration of past spending patterns, future projections, and current economic conditions.

A school might, for example, anticipate an increase in energy costs due to rising prices and factor this into its expenditure forecast.

If you’re unsure where to start, use the previous year as a benchmark. If this is your first year, look at similar schools in the area as a starting ground.

Creating the Budget

This document serves as a financial roadmap for the school year ahead, outlining how much will be spent in each category and where the funds will come from.

This step requires collaboration and consensus-building among stakeholders, including school administrators, headteachers, and the local authority. It may also involve difficult decisions about where to allocate resources and what priorities to focus on.

Implementing and Monitoring the Budget

This involves distributing funds as outlined in the budget and regularly monitoring expenditures to ensure they align with the budget.

For example, if a school has allocated a certain amount for classroom supplies, the purchasing department must ensure they stay within this limit when ordering supplies to prevent overspending.

Review and Adjust

At the end of the budget period, it’s time to review it and make adjustments for the next year. Carry out budget analysis reporting, investigate budget variances, and learn lessons to improve budget reporting and forecasting going forward.

This review process involves comparing actual income and expenditures with the estimates and analyzing discrepancies.

For example, if a school underestimated its maintenance costs, it would need to adjust these figures in the next budget.

This continuous cycle of review and adjustment allows schools to improve their budgeting processes over time based on real-world experience and evolving needs.

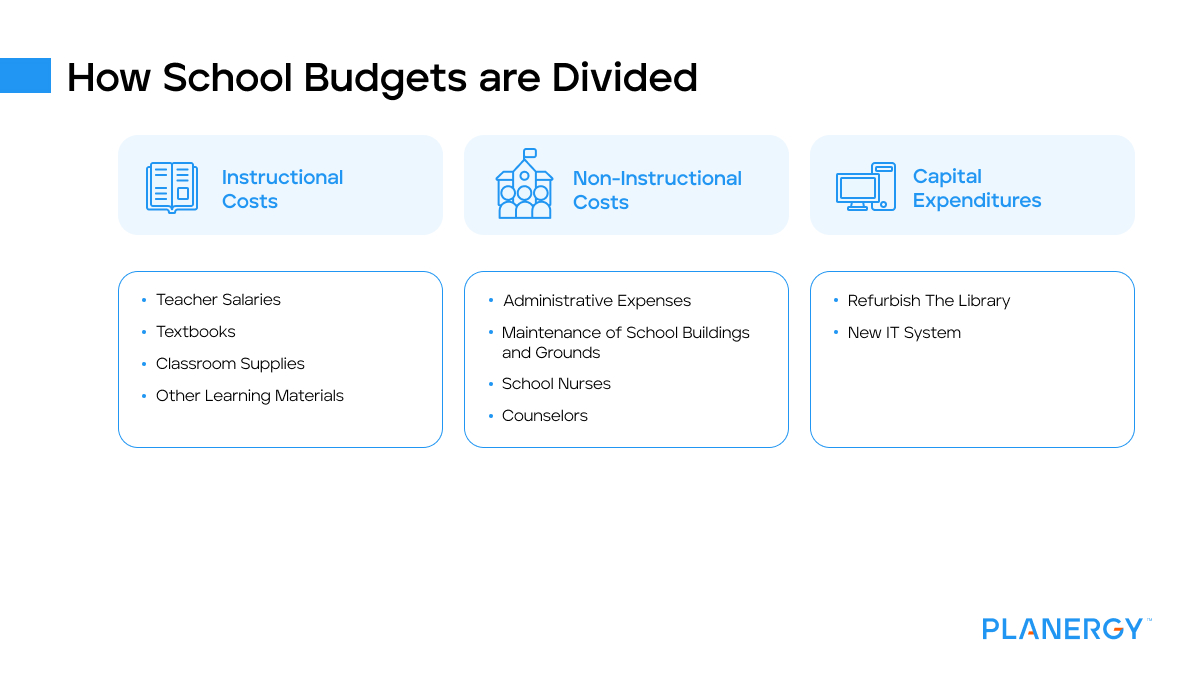

How School Budgets are Divided

Schools typically divide their budgets into different categories.

Instructional Costs: Investing in Learning

Instructional costs form the backbone of any school budget. These costs directly impact the quality of education provided to students. They include teacher salaries, textbooks, classroom supplies, and other learning materials.

For instance, a school focusing on improving academic performance might allocate a significant portion of its budget toward instructional costs.

This can involve investing in high-quality textbooks, hiring experienced teachers, or introducing new learning tools and technologies to enhance student engagement and learning outcomes.

Non-Instructional Costs: Supporting the School Ecosystem

Non-instructional costs are equally vital for the smooth operation of a school.

These day-to-day costs cover administrative expenses, maintenance of school buildings and grounds, and support providers like school nurses or counselors.

Schools need to allocate sufficient funds to these areas to ensure a safe, clean, and supportive environment for students.

For example, regular maintenance can prevent larger repair costs down the line. At the same time, investment in support services can help address student well-being and mental health, contributing to better academic outcomes.

Capital Expenditures: Building for the Future

Capital expenditures refer to major costs related to infrastructure improvements or technology upgrades. These are often large, one-off expenses that require careful planning and budgeting.

For example, a school might decide to refurbish its library or invest in a new IT system.

While these costs can be substantial, they are critical investments in the school’s future, enhancing the learning environment and equipping students with modern, up-to-date facilities and resources.

A school might allocate 60% of its budget to instructional costs, 30% to non-instructional costs, and the remaining 10% to capital expenditures.

Multi-Academy Trusts (MATs) and Their Unique Budgeting Approach

Multi-Academy Trusts (MATs) manage their budgeting differently. They receive their school funding from the Department for Education (DfE), which might be fully or partially centralised.

These academies are often comprised of both primary schools and secondary schools, and are inspected by Ofsted, just like maintained schools.

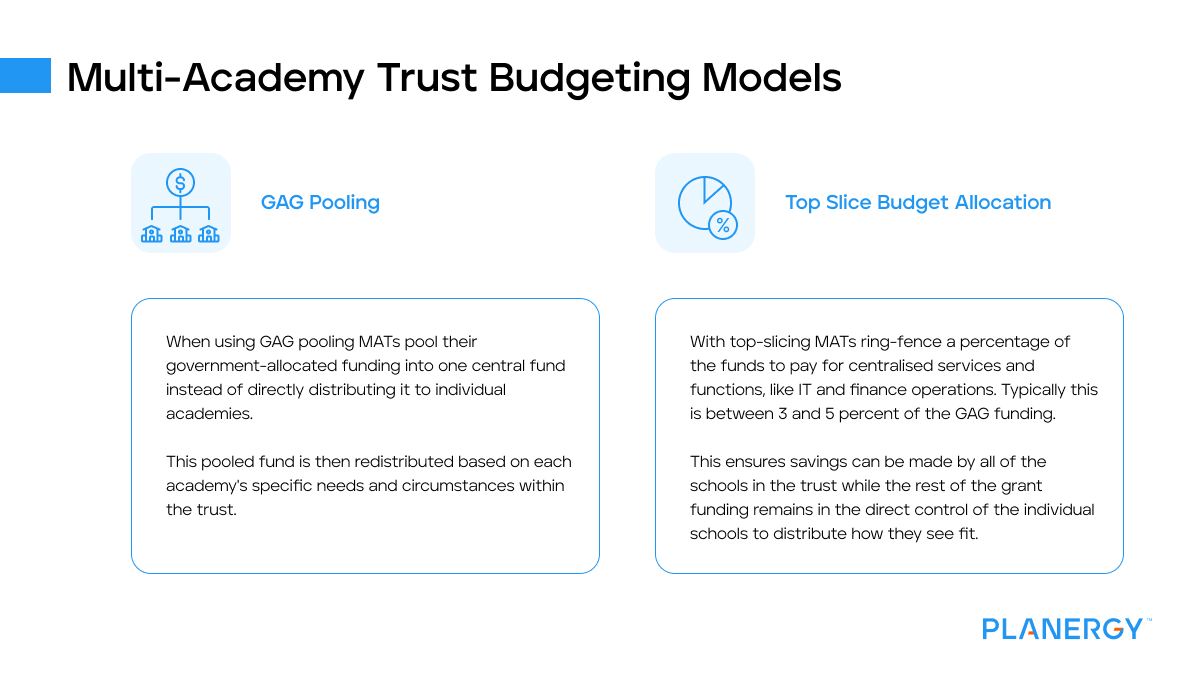

Two key concepts in MAT budgeting are GAG pooling and top-slice budget allocation.

GAG Pooling: A Strategy for Equity

GAG pooling stands for General Annual Grant pooling. This is a strategic financial approach adopted by MATs in the UK to ensure a more equitable distribution of resources among their academies.

Under this system, MATs pool their government-allocated funding into one central fund instead of directly distributing it to individual academies.

This pooled fund is then redistributed based on each academy’s specific needs and circumstances within the trust.

For example, an academy with more students with special educational needs might require additional resources to provide tailored support and services.

Through GAG pooling, the MAT can allocate more funds to this academy, ensuring all students across the trust have access to the necessary resources.

This approach moves away from a ‘my school’ mindset to an ‘all children in the MAT’ perspective.

It allows resources to be directed to areas where they are most needed, promoting equity and ensuring that every student, regardless of which academy they attend, has the opportunity to succeed.

However, it’s critical for MATs to manage this process transparently and consult with all stakeholders to ensure that the funds are being allocated fairly and effectively.

Regular reviews and adjustments may also be necessary to respond to changing needs and circumstances within the trust.

In essence, GAG pooling is about putting the collective needs of students first and using resources strategically to achieve the best possible outcomes for all.

GAG pooling is becoming the most popular approach for trusts.

Top-Slice Budget Allocation: Covering Central Services

Top-slice budget allocation is a common practice in MATs that ensures the provision of essential central services.

The term ‘top slice’ refers to a percentage of the total funding that is taken off the top – or deducted first – before the remaining funds are distributed among the academies within the trust.

These top-sliced funds are used to cover the costs of central services provided by the MAT.

These services can vary between trusts but often include areas such as human resources, legal support, financial management, strategic planning, and other overhead costs associated with running the trust.

For example, if a MAT receives a total grant of £1 million and decides on a 5% top slice, £50,000 would be allocated to cover central services.

The remaining £950,000 would then be distributed among the academies in the trust, either evenly or based on individual needs.

This approach ensures that all academies within the trust have access to essential services and expertise, which can lead to cost savings and efficiencies.

Instead of each academy having to fund these services independently, they can share the costs, allowing more funds to be directed toward teaching and learning.

Though not for profit, school’s must be managed as businesses to ensure continuous smooth operation for students and staff.

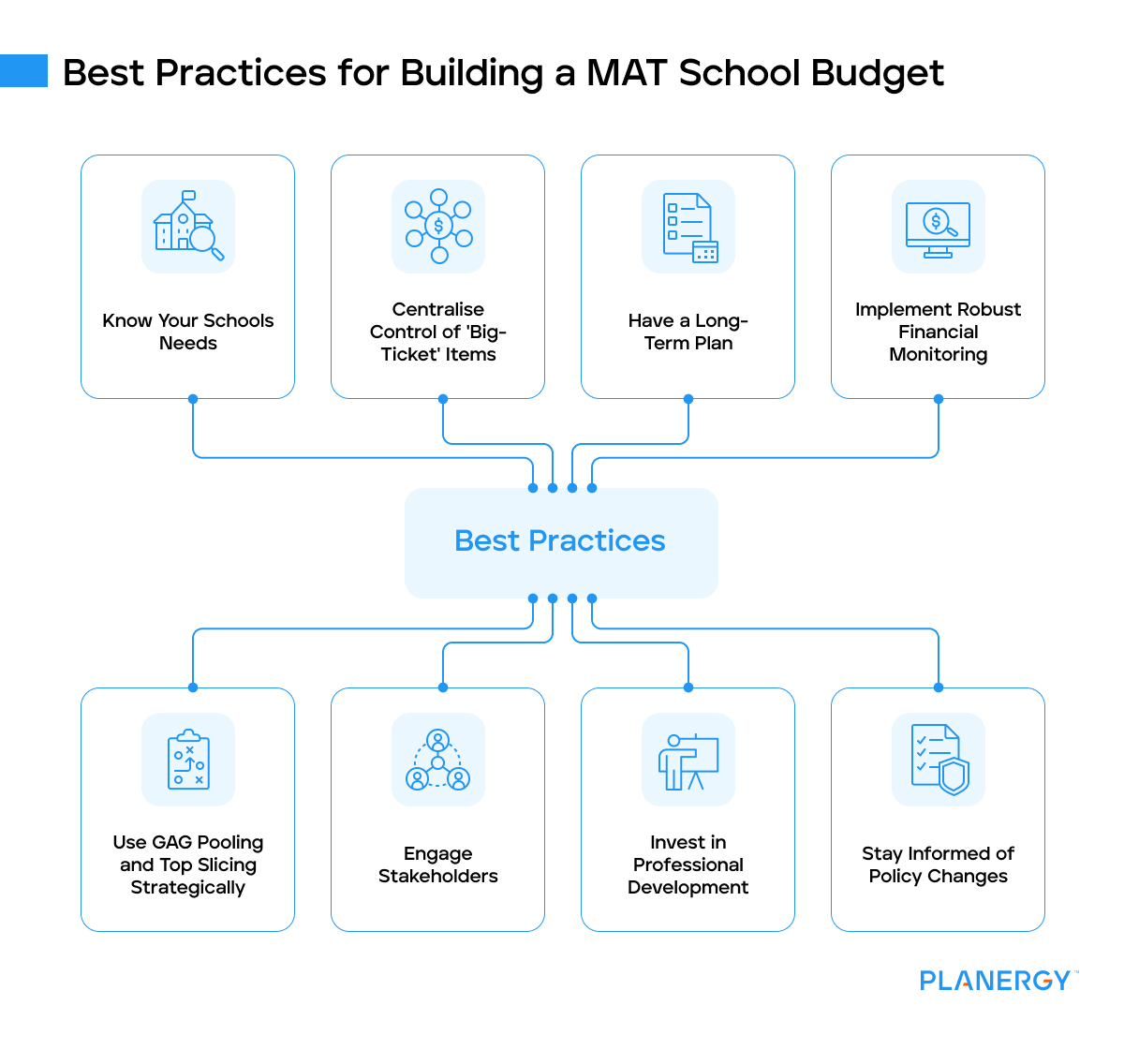

Best Practices for Building a MAT School Budget

Know Your Schools Needs

Understanding each academy’s unique needs, challenges, and opportunities within the trust is crucial.

This includes knowing the demographics of students, specific requirements, and performance metrics. This in-depth knowledge allows for a more tailored and effective budgeting process.

Centralise Control of ‘Big-Ticket’ Items

Large expenses that affect multiple academies within the trust should be managed centrally. This can lead to cost savings through economies of scale and ensure consistency across the trust.

Examples of big-ticket items might include IT/ICT infrastructure or learning management systems.

Putting this with your MATs governing body can get you better deals and helps avoid some of the common problems with education procurement, since you’re purchasing with a higher volume.

Have a Long-Term Plan

While annual budgets are important, having a long-term financial plan is crucial.

This rolling plan should look ahead at least three to five years, allowing the trust to plan for future investments, anticipate changes, and ensure financial sustainability.

Implement Robust Financial Monitoring

Regular monitoring of actual income and expenditure against budget projections is essential.

This allows for early identification of any issues or discrepancies and enables timely adjustments to be made. Financial reports should be clear, concise, and provided to all relevant stakeholders.

Use GAG Pooling and Top Slicing Strategically

GAG pooling and top slicing are powerful tools for MATs.

However, they need to be used strategically and transparently. Regular reviews and adjustments may be necessary to ensure funds are being allocated most effectively and fairly.

Engage Stakeholders

Effective budgeting isn’t a solo activity. It requires input from various stakeholders, including the local authority, school leaders, headteachers, and governors.

Regular communication and consultation can lead to a more informed and accepted budget.

Invest in Professional Development

Investing in the financial skills and knowledge of those involved in budgeting can pay dividends.

This can help ensure that budgets are realistic, strategic, and aligned with the trust’s educational objectives.

Stay Informed of Policy Changes

Government policies and funding arrangements can have significant implications for school budgets. Staying informed of any changes and understanding their impact is crucial.

Navigating Challenges in School Budgeting

Budgeting in education comes with a unique set of challenges. These obstacles can be significant but can be navigated successfully with strategic planning and effective management.

Balancing Staffing Costs

The largest expenditure for any school is staffing costs. Schools must ensure they have enough teachers to maintain a reasonable student-teacher ratio and provide quality education.

However, budget constraints can make paying more staff salaries difficult. Increases in staffing costs that are not matched in funding means school budgets are increasingly stretched.

Schools must balance hiring enough staff and staying within their budget.

For instance, a school might decide to invest in professional development for existing staff to increase their teaching capacity instead of hiring additional staff.

Another strategy could be employing part-time or substitute teachers to manage peak times.

Dealing with Funding Shortages

Another major challenge is dealing with funding shortages. Many schools rely heavily on government funding, which may not always be sufficient or reliable.

Schools need to have strategies in place to handle these situations.

This can include seeking additional funding sources such as grants, donations, or fundraising activities.

Schools may also consider cost-saving measures, like energy-efficient upgrades, to reduce utility costs.

Handling Unexpected Expenses

Unexpected expenses are another hurdle in school budgeting. These can range from sudden repair work to unforeseen events like natural disasters or public health emergencies.

Schools should aim to build a contingency fund into their budget to handle these situations.

This provides a financial cushion that can help cover unexpected costs without disrupting the school’s operations or dipping into funds allocated for other areas.

The Bottom Line

Effective budget management is key to the successful operation of schools and academies.

By understanding key budgeting concepts and practices, schools can use their resources most efficiently and effectively as possible to support their educational goals.

From setting clear financial objectives to navigating challenges with resilience, school budgeting is a dynamic process that requires continuous learning and adaptation.