In brief:

- Macroeconomic conditions have nearly half of U.S. hospitals facing negative margins, while labor shortages and inefficient processes slow revenue collection.

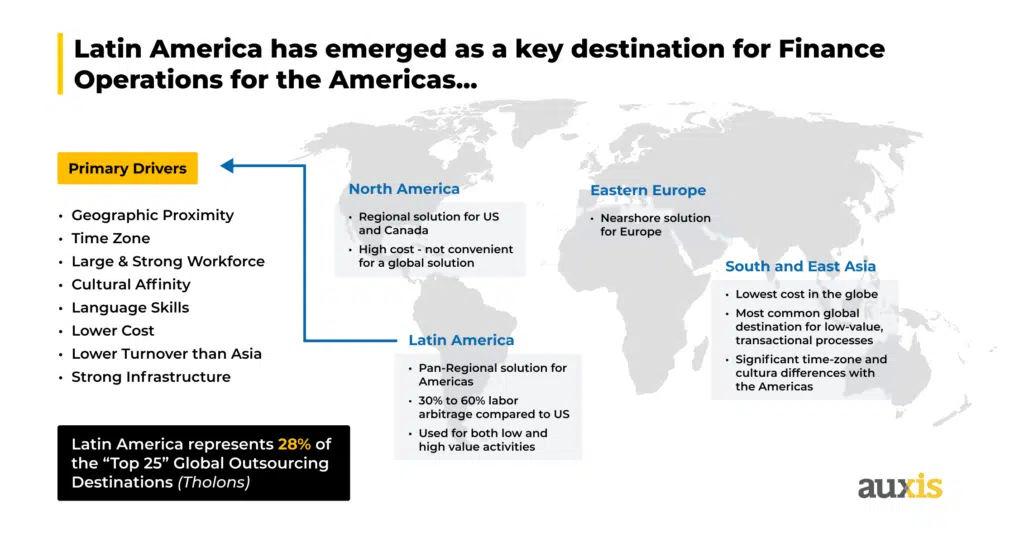

- Healthcare services are increasingly addressing these challenges by outsourcing the revenue cycle management process, using geographically close (i.e., nearshore) locations with highly educated populations as the preferred destinations.

- Top nearshore hubs deliver the real-time collaboration and higher-level talent needed to successfully support an advanced tier of judgment-intensive processes for the healthcare BPO market at a lower cost.

The top nearshore markets like Costa Rica and Colombia stand as a preferred destination for North American companies looking to outsource business operations in finance & accounting, IT, customer service, human resource management, and procurement. But, an urgent need to future-proof operations and contain rising healthcare costs is driving growth in a less traditional business process outsourcing (BPO) market: healthcare’s revenue cycle management (RCM).

Strategic revenue cycle management is the lifeblood of healthcare providers, working to alleviate bottom-line pressures and secure proper reimbursement for healthcare services.

But mounting pressures outside their control—including critical staff shortages, inflation, and rising healthcare costs—have nearly half of U.S. hospitals grappling with negative margins, according to Everest Group’s 2023 RCM matrix assessment.

Labor shortages and inefficient processes are slowing revenue collection in the healthcare industry, with nearly 1 in 4 RCM leaders needing to hire more than 20 additional employees to fully staff their departments, according to the Healthcare Financial Management Association’s 2022 Pulse Survey.

To confront these challenges, more than 60% of healthcare providers plan to outsource RCM activities this year, according to a RevCycleIntelligence report. Nearshore models have emerged as the go-to solution across the global healthcare BPO market – delivering the higher-level talent and real-time collaboration needed to successfully support an advanced tier of business processes at a fraction of the cost.

Latin America is on track to reach about 10% healthcare BPO market growth annually through 2027, surpassing $33 billion, states 2023 Market Data Forecast report.

Let’s examine the biggest benefits of partnering with a quality service provider in the nearshore healthcare BPO market: accelerating cash flow, reducing days outstanding, mitigating hiring challenges, and streamlining complex processes.

Read our previous blog, “Healthcare: Benefits of Outsourcing Revenue Cycle Management,” to discover important advantages healthcare organizations can achieve by nearshoring RCM processes – freeing you from revenue concerns so you can focus on patient care.

Proximity to the U.S. enables real-time communication and collaboration

A recent Medical Device News report credits the rise of nearshore outsourcing with the growth of the healthcare BPO market.

Outsourcing within the same region enables outsourcing services to function as a true extension of your internal team. It delivers cultural, time zone, and language similarities that drive agile, real-time communication and collaboration with patients, insurance companies, and your greater organization.

Popular destinations in the nearshore healthcare BPO market like Costa Rica and Colombia also offer quick, direct flights from many U.S. cities so you can easily access external teams.

Top-tier talent supports complex business processes at low operational costs

Cost savings are a given for nearshoring outsourcing, providing an average of 30-60% labor arbitrage in the healthcare industry. But leading nearshore locations like Costa Rica and Colombia ensure cost-effective outsourcing solutions without sacrificing quality.

Here’s why:

Top nearshore destinations deliver highly educated talent with the critical-thinking skills needed to successfully perform judgment-intensive activities like claims management. Strong English proficiency and neutral accents further avoid misunderstandings that can impact provider service at other global healthcare BPO market locations.

Costa Rica and Colombia offer robust multilingual capabilities as well, supporting 24/7 services in languages including Spanish, French, German, Portuguese, Russian, Mandarin, Japanese, Thai, and more.

The most mature shared services destination in Latin America, Costa Rica’s workforce is trained by the top educational system in the region. It also boasts the second-highest English proficiency in the region.

Ranked #1 on the Offshore BPO Confidence Index, Colombia stands out in the healthcare BPO market with one of the best higher education systems in Latin America. It boasts three universities in the Top 500 worldwide and 12 among the Top 100 in the region, according to the 2023 QS World University rankings.

Webinar Recap

The Rise of Nearshore Outsourcing in a Post-COVID Era: Why Costa Rica is a Great Choice

Finance, IT, Customer Service and more!

Deep talent pools familiar with U.S. healthcare requirements

Combat hiring challenges and high turnover in the U.S. via the deep talent pools in top nearshore healthcare BPO markets, driving the consistency that’s integral to the successful support of complex functions. For example, Colombia maintains the third-largest workforce in Latin America – creating potential for scalable operations in six metropolitan areas with 1 million+ inhabitants and 15 with 500,000+.

The deep familiarity with North American business practices that characterize top nearshore locations further ensures high-quality customer relationship management and support. More than 350 multinational organizations maintain Costa Rican operations, including Amazon, Procter & Gamble, and Abbott Vascular. Colombia supports over 200 foreign companies, including Johnson & Johnson, Medtronic, and AIG.

As a result, healthcare BPO services in these markets have extensive experience navigating the complexities of U.S. healthcare regulations like HIPAA, and maintaining stringent compliance frameworks that ensure security, data privacy, and adherence to billing and coding guidelines.

How one organization solved offshore healthcare BPO market challenges

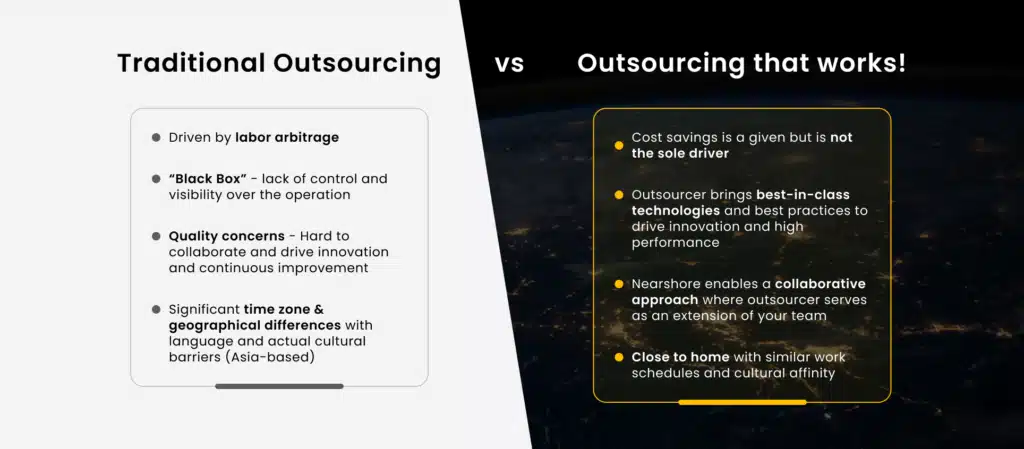

Not all healthcare BPO market services are created equal. As organizations begin to outsource higher-value work like revenue cycle management, the bottom-of-the-barrel pricing and overnight shifts needed to align with U.S. business hours in offshore locations like India leaves many providers struggling to attract skilled resources who can support higher-level processes.

The offshore healthcare BPO market also brings quality concerns stemming from cultural and language barriers, the difficulty of doing business across faraway time zones, high turnover that impacts performance consistency, and more.

Not surprisingly, a growing number of executives are rethinking offshore models as they look beyond the lowest cost to ensure the highest performance.

A leading U.S. healthcare provider looking for an alternative to offshore operations in the global healthcare BPO market took advantage of Auxis’ nearshore platform to address this situation:

As the U.S. labor shortage made it difficult and pricey to attract and retain staff at its onshore service center, the organization was looking to outsource revenue cycle management.

The company had already outsourced more transactional, back-office functions to Asia. But its leadership team was concerned that its existing solution lacked the right capabilities to successfully deliver a more advanced, judgment-intensive tier of healthcare services.

The organization was also struggling with traditional offshore challenges. For instance, language differences created difficulties surrounding medical terminology.

Partnering with Auxis to establish healthcare BPO services in Costa Rica delivered instant access to high-level talent with outstanding English fluency. The outsourced solution goes beyond labor arbitrage – delivering the skilled talent, cultural alignment, high-performance healthcare BPO services, easy communication, robust training, and transparent approach needed to seamlessly transition complex services and drive continuous improvement.

After a successful pilot, the company nearly tripled the size of Auxis’ Costa Rica team. It also expanded to 12 revenue cycle management functions, including payment applications, medical coding, claims management, billing services, collections, and more.

Why Auxis healthcare BPO: accelerating cash flow and organizational success

The healthcare industry is increasingly looking to the healthcare BPO market to solve its revenue cycle management challenges.

However, many healthcare organizations find that working with faraway teams impacts provider service, with offshore outsourcing services struggling to provide the higher-level talent and compatibilities needed to support an advanced tier of healthcare processes.

Partnering with a quality nearshore provider like Auxis delivers the top talent, real-time collaboration, and industry experience needed to navigate the complexities of revenue cycle management outsourcing: reducing administrative burdens and errors, improving cash flow, speeding turnaround times, and driving organizational success.

Interested in learning more about the benefits of outsourcing revenue cycle management to Latin America? Schedule a consultation with our nearshore healthcare BPO market experts today! You can also read our blog for more BPO tips and strategies or read our case studies for nearshore BPO success stories.