Learn how offshoring improves your productivity and helps grow your business.

The comprehensive offshoring primer for business owners and managers.

Hear from some delighted clients, and see our staff and facilities for yourself.

All your questions answered. Even those you hadn’t thought to ask yet.

Recognitions, awards and important offshoring updates.

Build your team and see your savings immediately using this free tool.

Deep-dive into the details of offshoring. Research reports, fact sheets & more.

Can't find what you're looking for? View the full list of roles here.

Outsourcing insurance claims handling processes

The insurance industry’s claims handling processes are quite resource intensive and claims can take a long time to process, from initiation to a decision being made. In fact, it can take around 1.5 months for a life insurance claim to be accepted1, 1.6 months for a trauma insurance claim and 1.5 months for an income protection claim to be processed. Insurance companies should always be on the lookout for ways to reduce these handling times to improve customer satisfaction and reduce costs.

A solution: outsourcing. In this blog, we will discuss the current state of the insurance market, what is outsourced insurance claims handling, why you should outsource your insurance claims handling processes and what claims handling tasks are suited to outsourcing.

Current state of the insurance market

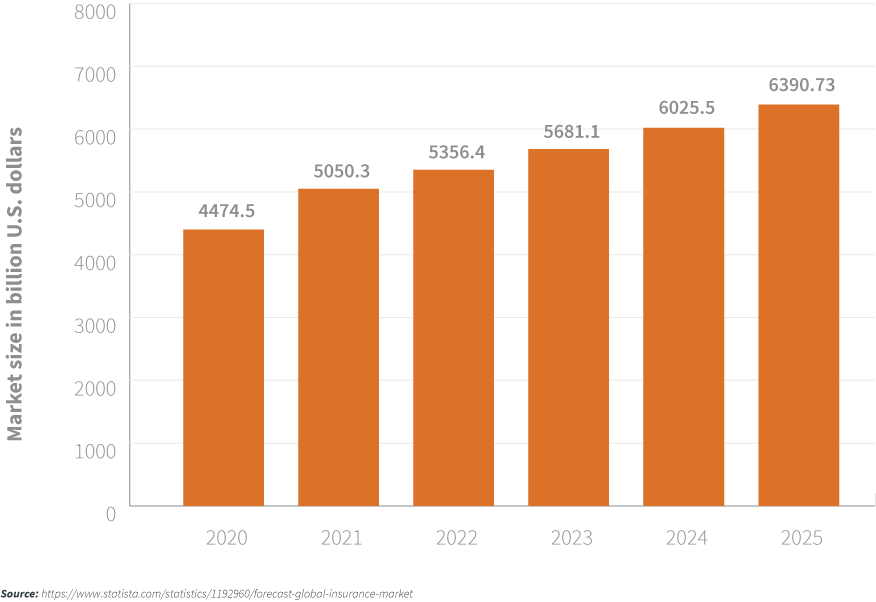

The global insurance market is expected to grow at a compound annual growth rate (CAGR) of 6% per year from 2021 - 2025, reaching U.S. $6.4 trillion2 by 2025. In a report curated by Deloitte3, they found “that despite ongoing COVID-19 concerns, insurers in general will expect more rapid growth in 2022, although non pandemic challenges around regulation, talent, sustainability and evolving consumer preferences may present speed bumps.” A key takeaway from this report is how a lot will depend on how insurance companies manage their investments, particularly in emerging technologies and people.

This comes down to their ability to balance automation with ‘human touch’ customer service, and implement flexible working models, like outsourcing. With the demand for insurance expected to keep rising worldwide, so will the need for better insurance claims handling processes. These flexible working models Deloitte mentions can be directly applied to insurance claims handling. In fact, outsourcing is a well-suited business model for insurance claims handling.

What is outsourced insurance claims handling?

Claims processing and handling is a large division in insurance operations involving the review, investigation, adjustment and remittance of insurance claims. Full-cycle claims handling is not always done by one person. You might have one team responsible for the review and investigation part, and another for the adjustment and remittance. Often, this is divided between junior and senior claims processors respectively. As a result, insurance claims handling works best in teams, reporting to an experienced team leader for advice and escalation.

Outsourced insurance claims handling is when a business engages a third-party organization out of house. This can be overseas, in the same country, or even just down the road. When outsourcing is done overseas, this is referred to as offshoring. Outsourcing the insurance claims management process can mean sending tasks externally such as lodging and managing claims as well as managing data, determining liability and liaising with external providers.

Why outsource your insurance claims handling?

Insurance companies are constantly on the lookout for ways to improve their overall market share and competitive advantage. Having dedicated outsourced insurance claims processing teams is one way to start. These teams have the experience, knowledge and skills required to process various insurance claims. Here are some reasons why outsourcing can benefit your insurance claims process.

- Reduce costs

Claims processing requires major investment in workforce capacity and infrastructure. Unexpected peaks in insurance claims because of natural disasters or global pandemics can result in sudden recruitment drives and those costs can add up. Not to mention the amount of time and resources it takes to process claims and fulfill compliance requirements that would be better spent on what matters in-house more, like establishing marketing strategies or maintaining key stakeholder relationships.

Outsourcing your insurance claims handling tasks can save your business up to 70% on labor costs alone.

-

Improve customer experience

Today’s consumer expects fast and quick results while at the same time, feeling supported and cared for throughout their claims process. Claims normally occur because of a stressful series of events for customers. If you want to retain customers long-term, you need to make sure the entire claims process is stress-free and easy for them.

Insurance outsourcing providers have high customer service standards for insurance claims handling and customer experience. It is even recommended that you liaise with your outsourcing provider to develop key performance indicators (KPIs) and communicate expectations around customer service.

-

Access to InsurTech

Experienced outsourcing providers are aware of the advanced technology insurance companies use for claims handling. By partnering with these third-party providers who possess an understanding of InsurTech, you can move your claims handling processes to a more efficient and digitally-driven environment.

Digital claims functionality can drive a 25 - 30% reduction in claim expenses4 and increase customer satisfaction scores by 20%. Access to these insurance-based technology systems will ultimately have a positive flow-on effect against multiple areas within your business, from costs through to customer experience.

-

24/7 claims support

Nature is unpredictable. There is no telling what can happen when your customer leaves their house each day. They could get into a car accident or hurt themselves walking down the stairs. Because you, as an insurance provider, can not plan for when your customers are going to need claims support, outsourcing providers offer the ability to have a 24/7 claims handling team.

That way, your customers will have peace of mind knowing that if anything happens to them, whenever it happens, they will be taken care of. This will boost your customer experience and competitive advantage significantly. Hiring 24/7 insurance claims processing teams in a lower-cost economy, like the Philippines, is often cheaper than if done so locally.

-

Business scalability

Offshoring your insurance claims processing tasks can help increase profits and supercharge your business for growth. By adding the extra capacity offshore, your onshore team will have more time to take on more work and grow your business sustainably.

Knowing the insurance claims tasks are in good hands, will allow your local employees the opportunity to shift focus on strategies for growth of customer relationships.

-

Increase flexibility and efficiency

Outsourcing will allow you to quickly and easily grow your team according to business needs. If a surge in insurance claims comes through, you can easily scale the size of your team offshore by hiring more claims processors to take care of the increased workload. Outsourcing allows you to add or remove claims processors depending on the requirements of the claims market.

What claims handling tasks can be outsourced?

Insurance claims processing duties and tasks you can outsource can include, but are not limited to:

- Reviewing claim submissions

- Obtaining and verifying information

- Correspondence with insurance agents and beneficiaries

- Preparing claim forms

- Record management and maintenance of insurance policies and claims in database systems

- Determining policy coverage and payout claim amounts.

These insurance claims processing tasks are all quite repetitive and compliance-based, requiring a high level of attention to detail, which makes them well-suited for outsourcing.

What’s next?

New technology, data-driven processes and growing customer demands have revolutionized all sectors but, certainly when it comes to cyber risk, insurers are “behind” compared to banking and some other financial sectors. There has never been a more important time for insurance executives to not only be across the current pain points in their industry but embrace simple, intelligent and cost-effective solutions to address them like outsourcing.

Popular posts

Newsletter sign up

Business growth and efficiency improvement hints and tips delivered direct to your inbox.

Related Posts

The insurance industry’s outsourcing solution

Given insurance companies exist to support others during difficult times, it is often forgotten they face massive challenges of their own. Those..

The trends set to shape the insurance industry post-pandemic

The COVID-19 pandemic has impacted the insurance industry in numerous ways, with the global insurance market contracting by -2.3% in 2020 as a..

What You Need to Know About Insurance Outsourcing

Outsourcing is nothing new in the insurance industry. In fact, insurance has led the way in many respects, adopting outsourcing to address a wide..