Financial Planning & Analysis (FP&A) is critical in every organization.

It is the driving force behind financial decision-making, providing essential insights that guide strategic planning and budgeting.

But what exactly is FP&A, and how is it evolving with the advent of real-time data? Let’s delve into the details.

Understanding FP&A

It’s a role within the finance department that involves budgeting, forecasting, and analyzing a company’s financial reports and metrics.

Often accounting ratios and formulas are used to measure performance of finance KPIs over time.

FP&A helps create a data-driven culture in a company. Research shows that data-driven organizations outperform their competitors.

FP&A professionals are responsible for understanding the financial implications of business decisions and providing strategic recommendations.

The role of FP&A includes:

Preparing Budgets and Forecasts

One of the primary responsibilities of FP&A professionals is preparing budgets and forecasts.

They work closely with various departments to understand their financial needs and project future expenses and revenue.

This process involves analyzing historical data, understanding market trends, and making informed assumptions about future performance.

Analyzing Financial Performance

FP&A analysts play a critical role in reviewing and interpreting financial results.

They scrutinize the company’s income statement, balance sheet, and cash flow statement to understand its financial health.

This analysis aids in identifying patterns, understanding variances between actual and projected figures, and highlighting areas of concern or opportunity.

Evaluating Business Performance

This includes tracking key performance indicators (KPIs), conducting variance analysis, and providing regular financial reports to management.

By doing so, FP&A professionals help ensure the company is on track to meet its financial objectives and can quickly identify and address any issues hindering progress.

Providing Actionable Insights

FP&A professionals don’t just crunch numbers; they provide actionable insights influencing strategic decision-making.

They use their understanding of finance and business operations to interpret complex data and make recommendations on cost savings, profitability improvement, and strategic investments.

Using finance business intelligence data, their insights can directly impact a company’s bottom line and drive its strategic direction.

So, is FP&A a good career?

Absolutely. It offers a unique blend of strategic thinking, data analysis, and communication skills.

While challenging, it offers immense job satisfaction and career growth.

Pros and Cons of FP&A

Benefits of Working in FP&A

High Demand for Skilled Professionals

One of the major advantages of pursuing a career in FP&A is the high demand for skilled professionals in this area.

According to the U.S. Bureau of Labor Statistics (BLS), the estimated growth in the field from 2021-2031 is 9%, which is faster than average.

As businesses increasingly recognize the importance of strategic financial planning and analysis, the need for knowledgeable FP&A practitioners continues to grow.

Flexibility and Autonomy

Working as an FP&A contractor or consultant can offer great flexibility and autonomy.

This can be an attractive prospect for those who value independence and prefer to have control over their work schedules and projects.

Growth and Learning Opportunities

FP&A roles provide ample opportunities for growth and learning.

Professionals in this field are constantly exposed to various aspects of the business, allowing them to broaden their understanding and hone their skills.

Stability

FP&A is one of the most stable job fields due to the constant need for financial planning and analysis, regardless of whether a business is struggling or thriving.

Challenges of Working in FP&A

Accessing Real-Time, Accurate Data

A significant challenge facing FP&A teams today is accessing real-time, accurate data.

Without this crucial information, finance teams may struggle to make informed decisions, leading to inefficiencies and missed opportunities.

Uncertainty

Working as an FP&A contractor or consultant can also come with a degree of uncertainty.

The nature of contract work can mean periods without assignments and a lack of job security.

You can counteract this uncertainty by aiming to work directly with a specific company as an employee rather than as a contractor.

However, doing so also means a potential loss of schedule flexibility.Pressure and Stress

The FP&A role can be stressful, given the responsibility of forecasting and budgeting.

These tasks require dealing with multiple data sources, assumptions, scenarios, and stakeholders, all while facing tight deadlines, changing expectations, and market volatility.

How Working in FP&A Used to Be

Before technology made it possible to process massive amounts of data in minutes, FP&A required manual data processing, which was labor-intensive, time-consuming, and riddled with error potential.

Limited Software

As great as they are for many things, spreadsheets were the only thing finance teams had to track crucial financial data and performance over time.

Sure, adding, subtracting, multiplying, and performing fairly complex math equations was easy, but inputs could only be edited by one person at a time – and you never knew if you had access to the most up-to-date information.

Using the best business budgeting software and procure-to-pay software with powerful reporting and analytics functionality, like Planergy, gives FP&A the tools they need to give actionable insights.

If you were working with an older file version, your work could be wasted. Spreadsheets lack advanced capabilities to deliver critical insights for strategic and operational planning.

Reliance on Historical Data

Finance professionals had no choice but to rely on past data and performance to find trends and patterns on which to base the path forward.

While looking in the rearview was certainly better than having no data at all to support any decisions, that left many companies blindsided by sudden changes in the business landscape or industry trends.

Can you imagine trying to predict tomorrow’s weather based on what happened yesterday? That’s pretty much what it was like.

Siloed Decision-Making

Without the ability to share information in real-time, with a cloud-based platform like we have today, the planning process was often handled in isolation.

With minimal cross-functional collaboration across departments, finance leaders were stuck making decisions based on the information at hand, regardless of what other information may be available.

Imagine only having a few pieces of the puzzle but trying to make sense of the full picture.

Reactive Analysis

Making decisions based on past data meant companies couldn’t quickly adapt to changes and properly seize new opportunities. This meant companies were always one step behind.

The finance transformation is one of many industries affected by the advent of new technology.

The Digital Transformation of FP&A

Today FP&A, and finance more generally, is undergoing a significant transformation driven by digital technology and the availability of real-time data.

Traditionally, FP&A relied on historical data and manual processes.

However, the digital revolution has ushered in a new era where real-time data and advanced analytics tools are reshaping the field.

Real-time data allows FP&A professionals to monitor business performance in real-time, carry out trend analysis to identify trends early, and make proactive decisions.

For example, real-time spend analytics like those available in Planergy provides instant visibility into expenditure, enabling better spend control and strategic decision-making.

However, the digital transformation of FP&A is not without its challenges.

The need for accurate, real-time data for strategic decisions is paramount, but achieving this can be difficult given data silos, data quality issues, and the complexity of integrating various data sources.

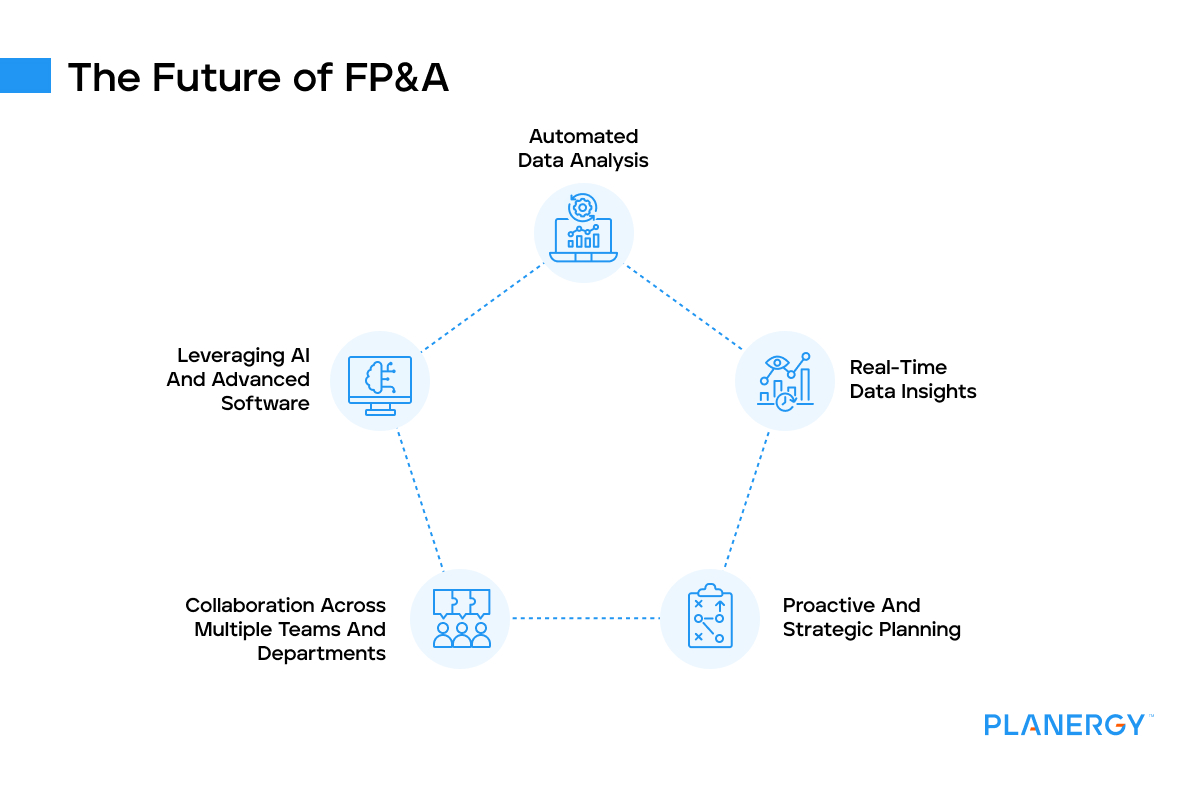

The Future of FP&A

The future of FP&A lies in its ability to harness the power of technology and data.

As artificial intelligence and machine learning become more prevalent, they will further automate the FP&A process, allowing for even more precise and timely insights.

Automated Data Analysis

Imagine if FP&A teams could harness the power of automation to turbocharge their data analysis of big data.

This isn’t some far-off fantasy; it’s the future of FP&A. Utilizing big data in finance efficiently to draw good insights is possible and getting easier with improvements in technology.

Brace yourself for an efficiency-boosting, quality-enhancing automation revolution.

Leveraging AI and Advanced Software

Cutting-edge software solutions will power the FP&A of tomorrow.

These pioneering technologies promise a new era where FP&A teams can easily sift through massive datasets, spot patterns, and generate predictive analytics.

AI in Procurement, AI in Accounts Payable, automated spend analysis, and even spend forecasting are now becoming a reality for even smaller businesses.

We’re already witnessing the dawn of this transformation, with FP&A teams mastering tools like ChatGPT for Excel and Microsoft’s Copilot.

As these pros continue to exploit advanced software and AI, they’ll unlock unprecedented accuracy and detail in their analysis, arming organizations to make data-driven decisions with renewed confidence.

Real-Time Data Insights

In the fast-paced world of business, having up-to-the-minute information is crucial. That’s why the FP&A teams of the future will embrace real-time data insights.

This shift promises faster, better-informed decision-making. With a constant stream of real-time data, FP&A professionals can monitor performance and adjust forecasts on the fly.

The result? A nimbler, more proactive FP&A team that fuels strategic growth and sharpens competitive edges.

Collaboration Across Multiple Teams and Departments

The FP&A role of the future will pivot on collaboration and cross-functional teamwork.

By dismantling the silos that once hindered knowledge-sharing, FP&A teams can align strategies more effectively and ensure stakeholders have the critical intel they need.

This collaborative approach promises a more unified, agile organization, ready to seize opportunities and tackle challenges head-on.

With strong cross-functional team leadership the future is bright for FP&A.Proactive and Strategic Planning

The future of FP&A is about shifting from reactive to proactive and strategic planning.

Armed with advanced tools, automation, and real-time data insights and dashboards, FP&A teams will be able to:

- Anticipate changes in the business landscape

- Identify opportunities

- Develop contingency plans

This forward-thinking approach will empower organizations to make strategic decisions, giving them the upper hand in a fiercely competitive market.

The Future of FP&A Has Already Started

The future of FP&A is here, and it’s nothing short of revolutionary.

Working with this FP&A transformation is a much different beast compared to what it was just a few years ago.

Automation and technology have opened up endless possibilities and potential for businesses.

Now, businesses can quickly process data, anticipate trends, and make informed decisions around finances that can ensure long-term security.

And, when combined with the skill sets of knowledgeable finance professionals and leaders, there are almost no limits to what can be accomplished today through FP&A.

For those looking to become experts in the field of FP&A or for those who already are critical members of financially thriving companies – the power of modern technology should not go understated as it has revolutionized an entire industry virtually overnight.