Rethinking The “S” In ESG: The Inclusive Finance Imperative

Over the coming years, sustainability will become a top priority for organisations, and companies’ ability to transform themselves will prove critical to surviving and capitalising on this new wave of business disruption. As allocators of capital and risk underwriters, financial services firms have a large role to play in this transition to a more sustainable world that customers and regulators demand.

Forrester’s research into sustainable finance reveals that many financial services organisations are keen to drive environmental, social, and governance (ESG) initiatives. Environmental initiatives have long dominated the sustainability agenda. But rare are the financial services firms prioritising social issues — and that’s a missed opportunity.

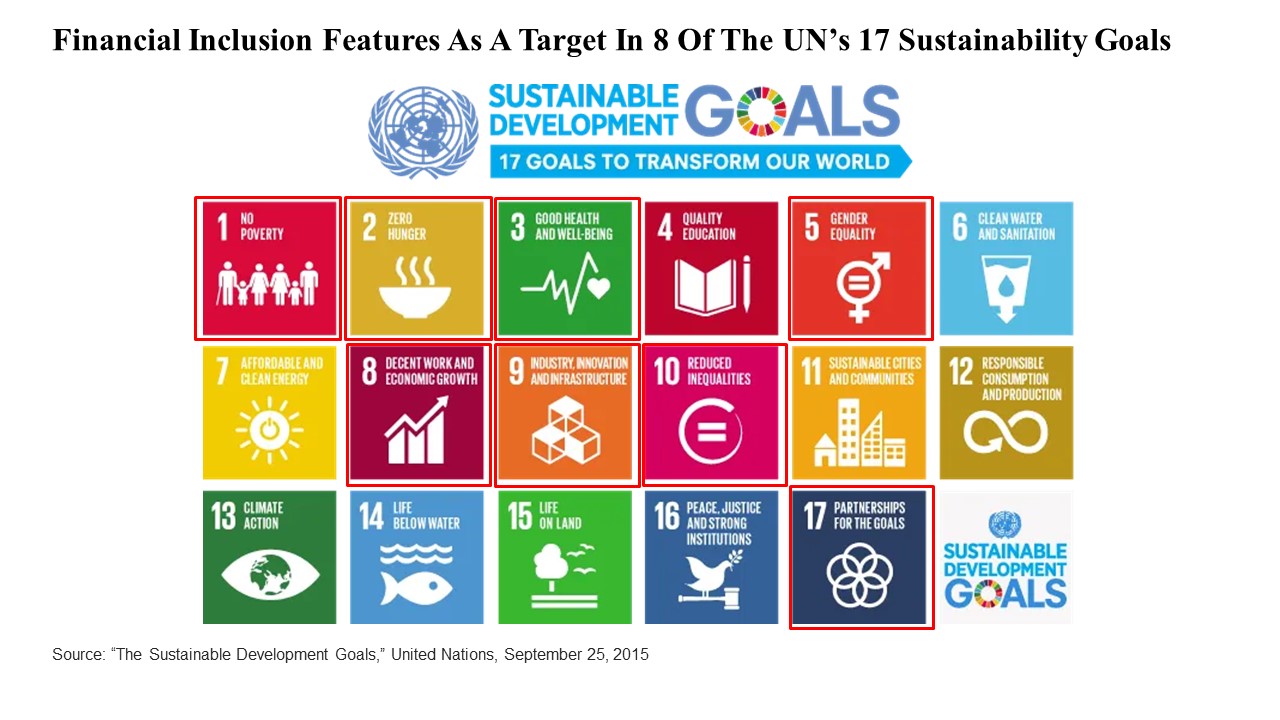

COVID-19 has brought the “S” in ESG into the spotlight, and the “middle child” of ESG is now front of mind for governments, consumers, and investors. Financial inclusion, in particular, has been increasingly championed over the past year as a way to improve people’s livelihoods, reduce poverty, and advance economic development in the aftermath of the pandemic.

The Pandemic Has Reignited The Need To Prioritise Inclusive Finance

The COVID-19 pandemic has had a huge impact on financial inclusion globally by:

- Reversing social and economic development gains that had taken decades to achieve. Just before the pandemic hit, at the end of 2019, the world was experiencing the longest period of sustained growth and improvement in human welfare in history. Between 1999 and 2019, over a billion people escaped extreme poverty. The COVID-19 crisis reversed that trend, upending livelihoods across the world and sending millions of people back into poverty. The pandemic also widened inequalities between generations, nations, and communities. Women, alongside the poor, elderly, disabled, and migrant populations, have been disproportionally affected.

- Widening the digital gap. According to the World Bank, there are still 1.7 billion adults worldwide without an account at a financial institution or a mobile money account. The problem is not limited to developing and emerging countries. According to the findings from the FDIC’s 2019 Survey of Household Use of Banking and Financial Services, 17.9% of households in the US in 2019 were underbanked, while 5.4% were unbanked. The rapid digitisation brought by COVID-19 has decreased the overall number of unbanked consumers. But the number of underserved may have increased. While digital technologies (and sometimes changes in national policy) have created opportunities for many people to get easier access to financial services, unreliable internet access and the lack of affordable tools or digital skills have also created a digital divide. Significant challenges remain. We need a better understanding of the opportunities and risks posed by digital innovations when it comes to providing access to financial services. Many barriers and challenges of personal circumstance can result in people experiencing financial exclusion. A lack of formal ID is a critical obstacle to financial inclusion. In fact, any form of disability or discrimination could potentially serve as a barrier to accessing financial services, if the right guidelines, processes, and technologies are not in place.

- Highlighting the vital role of inclusive financial systems in a time of crisis. During the pandemic, governments around the world relied on digital payments systems to provide financial assistance to people in need. Flexibility in credit helped sustain small businesses. Millions of people who lost their livelihoods were able to rely on savings and remittances. Countries that had built inclusive financial ecosystems were better prepared to respond to the crisis, such as, for instance, the digital infrastructure India Stack, which was built to ensure financial inclusion and deeper penetration of financial services in India. The pandemic has also forced financial services providers to speed up their digital transformation and move quickly to offer solutions that they weren’t offering before and has encouraged governments to come together with the telecom industry to rapidly implement policy changes and facilitate wider access to digital financial services — including, for example, relaxed know-your-customer (KYC) requirements for mobile money.

Finserv Organisations Need To Broaden Their Understanding of Financial Inclusion To Get It Right

Financial services firms have a rather myopic understanding of what financial inclusion means. As a result, they often have the wrong focus when they try to tackle it and fail to recognise the business benefits of advancing it.

- The idea of financial inclusion is still dogged by a number of misconceptions. Many organisations still see financial inclusion as limited to low- and middle-income countries or “banking the unbanked,” or else as a charitable venture.

- Firms miss out on the business opportunity of making customers’ experiences inclusive. Diversity, equity, and inclusion (DEI) is no longer merely about compliance and talent management but entails increasingly critical issues for organisations. Companies newly concerned about DEI have launched efforts to increase it in the workplace. But this employee-only scope of firms’ DEI initiatives will cause them to miss out on the business opportunity of inclusive design and digital accessibility.

- Meanwhile, new entrants enable inclusive finance through innovation. Mobile technologies, the internet of things, 5G, AI, smart data, automation, open finance, digital identity, and central bank digital currency offer opportunities to create a more efficient, accessible, secure, purposeful, and equitable financial system. A new breed of fintechs has emerged — such as, for instance, the Chinese digital bank WeBank — innovating at every step of the financial services value chain, often through new value propositions, including more flexible products and better ways to address the financial challenges faced by underserved customers. These companies focus on the needs of underserved groups to unlock innovation, accelerate customer centricity, win in new markets, and drive revenue growth and profit.

Organisations should focus on inclusive finance, which aims to enhance fair access for individuals and businesses to a wide range of affordable financial products and services that meet customer needs and are delivered in a responsible and sustainable way.

In the coming decade, forward-thinking financial services firms that recognise the shift and foster digital equity and inclusive finance through innovation to drive sustainable growth will gain a competitive advantage and grow faster.

To go further on this topic

If you want to learn more about inclusive finance and how it can help your organization improve customer experience, join me at our upcoming event CX EMEA 2022, from June 22 – 23. Full agenda here. If you’re a Forrester client, your organisation may have pre-purchased tickets available. Email us to find out.