Ranking And Prioritizing Channel Partners: To Tier Or Not To Tier?

Based on evolving B2B buyer needs and preferences, investing and collaborating with your channel partners is becoming increasingly prevalent and important. That said, it is unwise and unrealistic to support all partners in your ecosystem equally. Aligning resources to engage and enable the right ones is crucial. The challenge is how best to segment and prioritize partners accurately, fairly, and legally. Is the traditional approach, partner tiering, the best approach to channel partner segmentation?

The Traditional Approach: Partner Tiering

The traditional channel partner segmentation and prioritization approach, and the primary method used by 98% of the top IT (information technology) partner programs, is tiers (or levels). Each program tier has a higher level of requirements in return for a higher level of benefits. The standard practice is to categorize partners into an average of three tiers, using a naming convention that conveys “good, better, best.” Yet despite the widespread use of tiering, this approach has several shortcomings:

- Results in missed opportunities. Over the years, programs have expanded to include tiering criteria such as certifications and customer satisfaction. Revenue attainment is still the primary criterion, however, for moving up to a higher tier in most partner programs. There are several concerns with this criterion. For one, it is difficult for smaller partners, or partners in small markets, to reach the highest partner level — even if they are doing all the right things to drive customer and supplier success. Also, by exclusively prioritizing the top performers, it is easy to overlook emerging superstars. Finally, revenue is a lagging indicator. It tells you what a partner did in the past — not what they are capable of doing in the future.

- Excludes new types of partners in supplier ecosystems. A growing priority is expanding beyond resellers working independently to partner ecosystems: a network of diverse types of partners — some transacting and some nontransacting — working together to help customers achieve their business outcomes. Under this model, a prioritization approach primarily based on revenue attainment is risky. It makes it easy to overlook partners who would rather refer qualified leads or deliver incremental services than resell.

- Provides no end-customer value. Historically, suppliers implemented tiering to also provide partners with endorsement and differentiation in the marketplace. Customers do not select a partner based on how much they sell or because of their label, however. Based on the results of Forrester’s Buyers’ Journey Survey, they are more interested in their expertise, reputation, and experience.

Partner Tiering Pros And Cons

Based on the trade-offs to partner tiering, there is ongoing industry debate around the merits of dropping this ranking approach. Many tiering approaches need to be “refreshed” or supplemented with other approaches. Partner tiering need not be eliminated, however. The benefits of a well-defined and well-enforced partner tiering program include the following:

- Motivates performance. When structured properly, partner tiering has proven effective in molding behavior and motivating higher levels of engagement and performance.

- Provides expectation clarity. Tiering makes it clear to partners what the supplier needs and expects from them: the program requirements. It also provides clarity on what partners will receive in return for meeting their requirements: the program benefits.

- Mitigates legal (and ethical) entanglements. Anti-trust laws (such as Robinson-Patman) require suppliers to treat partners who have the same business characteristics in the same way, including discounts, incentives, and support resources. Having well-documented tiering criteria demonstrates material differences between one group of partners over the others, thus establishing that the supplier’s intent is not to unfairly benefit one partner over another.

An Actionable Approach: Profiling, Scoring, And Plotting

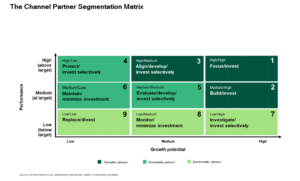

A more strategic way of looking at a portfolio of partners is the Forrester Channel Partner Segmentation Matrix. It assesses and classifies partners into nine distinct categories based on not just current performance (Y-axis) but also future potential (X-axis). The tool is not intended as a replacement for a company’s public-facing partner program tiers. It is an internal overlay approach that delivers the following benefits:

- Easy-to-understand, visual data. You can easily and quickly see the current performance and future potential of an individual partner. It also provides immediate clarity on where an organization should focus effort and prioritize resources — the “high-potential” partners in the three boxes highlighted in dark green in the upper-right quadrant (boxes 1–3).

- Actionable intelligence. Insight is provided on the level of engagement and type of investment that is appropriate for each of the nine partner categories. For example, avoid allocating resources to the partners in box 9 at the bottom-left. They should either be removed from the partner program or solely supported via self-service (i.e., the partner portal).

- The appropriate partner enablement strategy. The scoring can provide insights into the right enablement strategy to drive performance improvement. For example, if a partner scores low on the number of qualified leads they produce, they may need additional marketing training and support.

Final Words Of Advice

Before implementing the Forrester Channel Partner Segmentation Matrix, secure experienced, professional support to help select the right metrics to complete the assessments. This will help prevent the use of measures that are unreliable, biased, or otherwise useless.