Digital Retail Payments Continue To Grow In Post-Pandemic Asia Pacific

In recent years, digital retail payments have transformed the way we shop and conduct financial transactions. With the COVID-19 pandemic accelerating the adoption of digital payments, it’s no surprise that the digital payments landscape is constantly evolving. Looking at the post-pandemic state of digital retail payments in five major APAC markets, including Australia, mainland China, Hong Kong, Singapore, and Malaysia, we have seen four major trends that are shaping the industry:

- Cash is making a comeback, even as digital payments continue to grow. As COVID-19 restrictions eased in 2022 in most countries, APAC consumers gradually returned to in-person experiences; their use of cash rebounded but did not return to pre-pandemic levels, and we expect that it never will. Meanwhile, growth in digital retail payments held steady. In the APAC markets that Forrester surveyed, digital payment usage was higher in 2022 than prior to the pandemic, a trend that we expect to continue.

- Economic and regulatory changes have affected BNPL usage. “Buy now, pay later” (BNPL) has surged among the Gen Z and Millennial working population, but this is likely to ebb as the economy slows. The percentage of metro Chinese online adults reporting that they used BNPL to pay for a purchase in the preceding three months declined from 14% in 2021 to 8% in 2022. We also expect countries in APAC to follow the lead of the UK government and regulate BNPL more stringently, which could further dampen its prospects.

- Consumers in high-growth markets use digital retail payments more … More consumers in Indonesia and Malaysia use digital retail payments than in established economies such as Australia, Hong Kong, and Singapore. Consumers in these high-growth market are often younger and more tech-savvy, making them more likely to adopt new payment technologies. Additionally, many consumers in these markets are unbanked or underbanked, making digital payments a more convenient and accessible option for them.

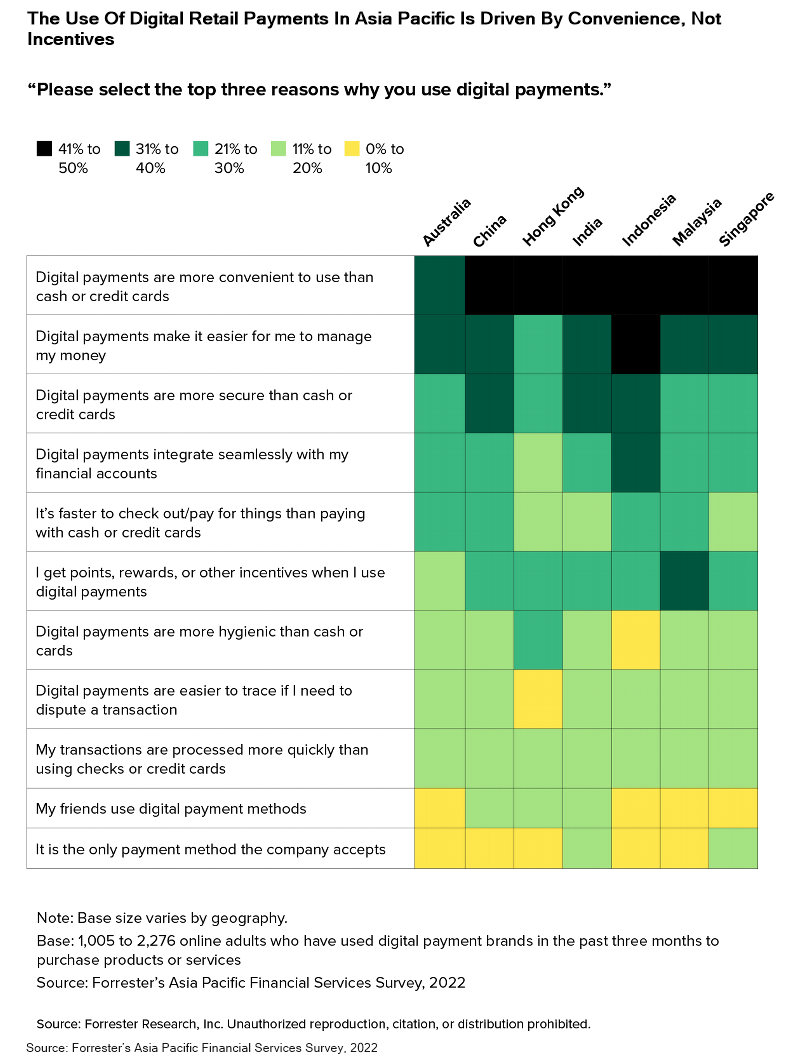

- … and use them for convenience, not incentives. In 2022, the reasons that APAC online adults most frequently selected as to why they use digital payments include greater convenience than cash or credit cards and easier money management. In contrast, getting rewards, points, or other incentives is not as critical as ease and convenience (see figure).

As the digital payments landscape continues to evolve, it’s important for businesses to stay up to date on the latest trends and developments. By understanding the preferences and behaviors of consumers in different Asia Pacific markets, banks, payment companies, fintech firms, and merchants can better tailor their payment strategies to meet their customers’ needs. The State Of Digital Retail Payments In Asia Pacific In 2023 report uses data from Forrester’s Asia Pacific Financial Services Survey, 2022, to help readers understand the landscape, opportunities, and challenges of digital retail payments in APAC.

To learn more details, Forrester clients can read the full report or schedule a guidance session or an inquiry.