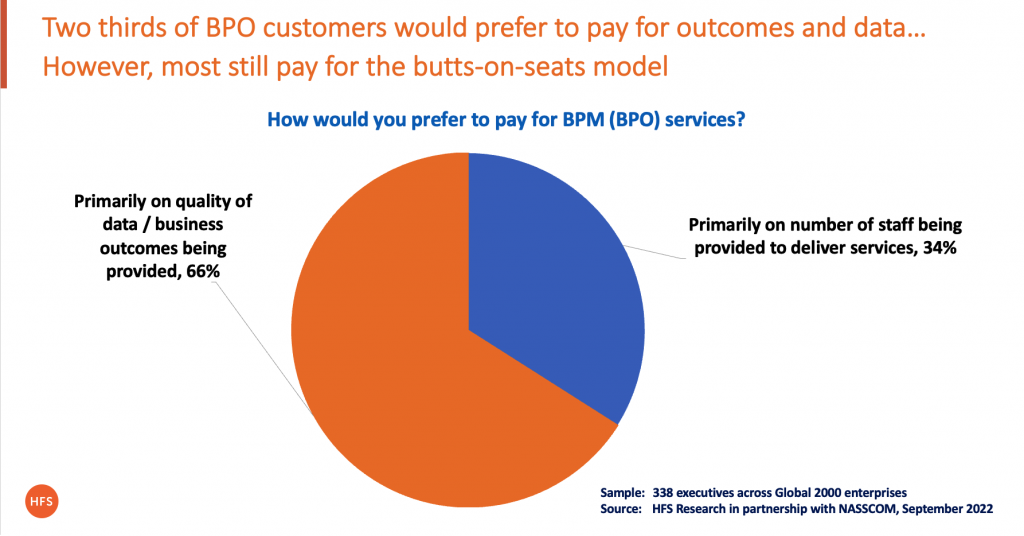

Today’s current “effort-based” BPO (BPM) services model is failing, but there is hope that this industry can course-correct its outmoded ways of behaving, with two-thirds of enterprise leaders preferring an outcome-based approach. Here’s why:

The economics of the current services model are capitulating

About 90% of business process outsourcing engagements are still largely priced and valued on low-cost labor. Moreover, that labor is becoming increasingly costly as inflation deeply kicks in and the talent supply drains away – especially at the lower-income levels. Service providers will walk away from many of their clients as they simply can’t make the numbers work to deliver their contracted services effectively and profitably. It’s becoming a painful race to the bottom… a zero-sum game that could see the BPO industry rapidly consolidate – and even shrink – if enterprises and their service partners cannot change how they engage with each other.

Our new research, which we will be presenting at the NASSCOM’s Business Process Innovation Showcase next month (see details), is revealing an industry primed for some fundamental changes as the current “effort-based” model becomes more and more misaligned for clients seeking better data, better performance, and much more dynamic partnerships to help them operate effectively in the current climate:

The purposes of client and provider must be aligned, or the relationship ultimately fails

When engagements are priced on the number of people, there is very little incentive to explore new methods of creating value, such as automation, AI, quality data, etc. The service provider is incentivized to maintain/increase the staffing levels, not invest in programs to reduce manual dependencies. Enterprises need to pay for performance, not effort if they ultimately want to benefit from sharing a common purpose with their provider. Net-net enterprises and their service partners must be motivated to achieve the same goals if they want to enjoy a long-term, mutually beneficial relationship.

Why legacy many services engagements become bad business deals

So what incentive does the provider have to become more effort-efficient if they will be penalized financially? The short answer is that there is no incentive, which is why many services engagements move to different service providers when contracts end. In most cases, it’s preferable for the incumbent provider to lose the business rather than cannibalize its own revenues with that client.

The sad reality is that the enterprise client just lost a service partner which has years of experience running their institutional processes – which could probably have automated the crap out of them and delivered a game-changing scenario. But they just had no financial incentive to do so. So the cycle continues, and that same client has to go through the same dog-and-pony show with another provider for the next 5-10 years. They still have the same crappy operations that will remain crappy with another partner, which also has little incentive but to deliver the same crap to maintain the effort levels as bloated as possible, to keep the business as profitable for themselves.

So what needs to change to get the focus on value versus effort?

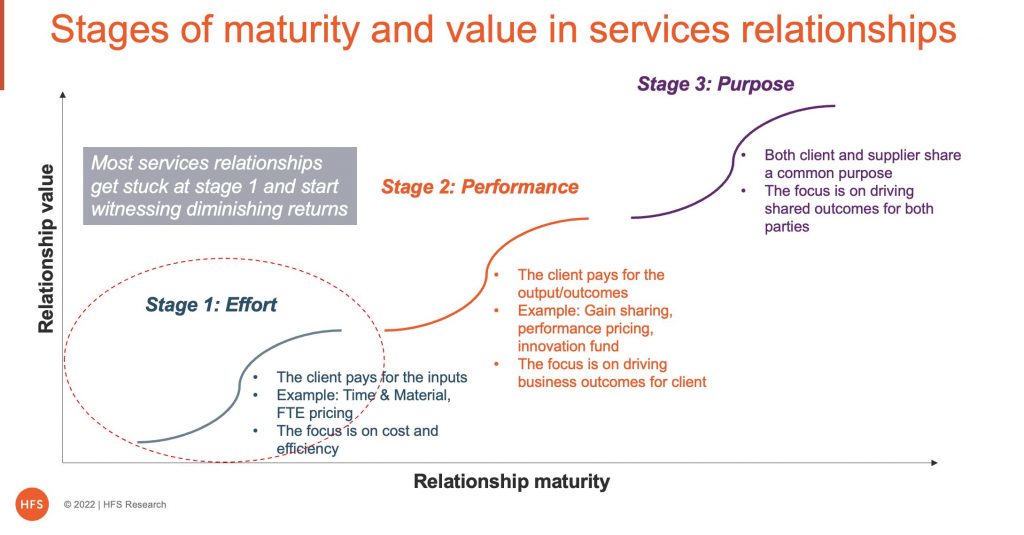

Clients and suppliers need to jump to a new S-curve of value creation where the client pays for the performance, not just the effort (See Exhibit below). Performance should be measured based on some attribute of business value, not just cost and efficiency. Business value can be defined in terms of working capital optimization, speed-to-market, improvement in business metrics (e.g., DSO or DPO), customer/employee satisfaction (e.g., NPS score), or procurement spend reduction.

Most services relationships get stuck at stage 1 and start witnessing diminishing returns because you just cannot keep squeezing the lemon for more juice. In a performance-driven relationship, the supplier and client share the risk and reward while providing services at the lowest cost possible starts to become a given.

Most sourcing advisory consultants describe a gain-sharing approach at this stage, but be careful as gain-sharing can drive opposite behavior than initially envisaged. A “pay-for-performance” pricing is often more practical. This is how it works:

- Identify the desired outcome for a potential relationship by milestone

- Supplier proposes fixed service fees to implement milestone

- X% of Supplier fixed fees “at risk” for non-performance

- Supplier earns a “performance bonus” (up to Y% of fixed fees) if it exceeds project Savings Target

This pay-for-performance pricing is simple, transparent, and mutually beneficial as the service provider is incentivized to create value, it is relatively straightforward to track and measure, and the buyer payouts cannot be so huge that they can cause budgetary issues.

A gain share model backed with an “innovation fund” is also a better idea than pure gain sharing. Here the supplier (and buyer) commits to a pool of money to drive innovation. A joint innovation council identifies potential projects and uses the innovation fund. The supplier recovers its investment using a gain-share approach with a potential upside if the project is a huge success and a downside if it fails.

Finding a common purpose in a relationship can convert it into a growth engine for both parties

The most mature relationships are not based on math on some complex savings calculations but on a shared drive or goal (see stage 3 above). This is where co-creation happens. When combined with the supplier’s experience and technology, the buyer’s data and real-life business context create a unique solution that can be taken to the market jointly, with both parties sharing the potential windfall. Suppliers struggle to develop innovative solutions in a vacuum, and co-creation allows buyers to drive the partnership toward revenue creation. Purpose-driven associations rely on each other’s strengths to build a strategic, mutually beneficial relationship. A recent example is where bp and Microsoft formed a strategic partnership to drive digital energy innovation and advance net zero goals. Microsoft would further bp’s digital transformation with Azure, while bp would supply Microsoft with renewable energy to help meet the company’s 2025 renewable energy goals.

Bottomline: There is no pricing nirvana in IT and business services. But pricing structures should evolve as the relationship matures from effort to performance to purpose

Each pricing structure – input or effort based (e.g., FTE-based), output-based (e.g., price per transaction processed), or outcome-based (e.g., gain sharing, pay-for-performance, innovation fund) has its pros and cons. It generally makes sense to start a new relationship with some effort-based pricing to establish the baselines and build trust, but then it is time to move on to pay for value.

Where we are seeing most progress toward performance-based relationships is when the CEO gets involved to learn the nuances and value of moving towards areas of common purpose that can also involve other entities in that industry ecosystem. The challenge for service providers is to have leaders capable of developing C-suite relationships and changing that age-old master-servant conversation to one of common purpose to create mutual value.

Posted in : Business Data Services, Business Process Outsourcing (BPO), Buyers' Sourcing Best Practices, IT Outsourcing / IT Services, OneEcosystem, OneOffice, Uncategorized