What Happens To Trust In Times of Economic Volatility?

The 2020s are already being defined by extraordinary political and social instability, creating an environment of uncertainty that makes trust an imperative for all organizations. In these times, customers, employees, and partners increasingly turn to businesses that they can believe in and that give them confidence in their future actions based on a clear set of values.

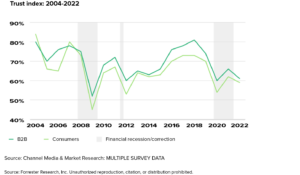

Many things influence underlying levels of trust, among them systemic factors. This is starkly revealed in new data that shows how levels of trust in businesses have fluctuated over the last couple of decades (see figure below). The data set is a meta-analysis of over 23,000 responses to numerous different market research surveys of both consumer and B2B audiences. Contrary to traditional thinking, which argues that underlying levels of trust have been in steady decline for years, this data suggests that trust among consumers and B2B buyers rises and falls in time with broad-scale economic and societal factors.

Looking at the data, we can see clearly how underlying levels of trust change in line with economic factors. The Great Recession of 2007–2009 coincides with a sharp decline in trust, and we see the same effect during the “Black Monday” market correction in mid-2011 and during the COVID-19 recession. In many ways, levels of trust follow market confidence data, with trust being more difficult to retain during bad times and rising during good. While it makes sense that challenging economic times result in crises of confidence and therefore heighten the focus on trust, the reasons for swings to greater trust in the good times are less clear. The upswing may simply be related to there being less need to feel safe when everything else is going well. And some research suggests that during an extended recession or crisis, levels of trust begin to climb, an effect that seems to be observable in our data during the COVID-19 pandemic and recession.

We also know that, in a time of crisis, people turn to the institutions that they trust the most. In Forrester’s Consumer Trust Imperative Survey, 2022, only 32% of US respondents said they trusted the government to follow through on their promises, and yet 64% trusted their employer. That said, most businesses have a very inflated sense of how much they are trusted: In Forrester’s 2021 Brand And Communications Survey, 85% of respondents thought they were better than average at following through on their commitments. There is a trust gap, with businesses presupposing levels of trust among buyers and others that don’t exist.

We may be entering a new period of economic slowdown or possible recession, and we might anticipate that trust will become more salient and that the trust gap will widen. Business leaders need to plan for this and understand how trust is earned and retained (see The Trust Imperative report). You can start this process by understanding the different dimensions or levers of trust, including which are most relevant for your brand. Create an action plan that prioritizes activities that will build and preserve your hard-won trust equity. Align and integrate trust to your ongoing employee and customer experience initiatives.

It’s understood that trusted organizations build stronger bonds with customers, attract the best talent, and create lasting engagements with their partners, all while minimizing risk. In hard times, these actions are all essential, and trust becomes more important than ever.