Client Profile

Our privately backed, Connecticut-based client is a global leader in industrial machinery manufacturing, specializing in extrusion and converting technology, serving the automotive, building/construction, consumer products, medical, and packaging industries. The company has grown to 1,400+ employees worldwide since it was founded 175 years ago, including manufacturing and technical facilities in the U.S., Canada, China, Germany, Finland, and more. It also maintains a network of independent sales agents and suppliers in nearly every country.

Business Challenge

The month-end close often stands as the biggest pain point in the Finance Department. Rife with time-consuming, tedious tasks like tracking down data from other departments, ensuring every transaction is recorded, and catching and correcting errors, inefficiencies often translate into long hours and missed deadlines.

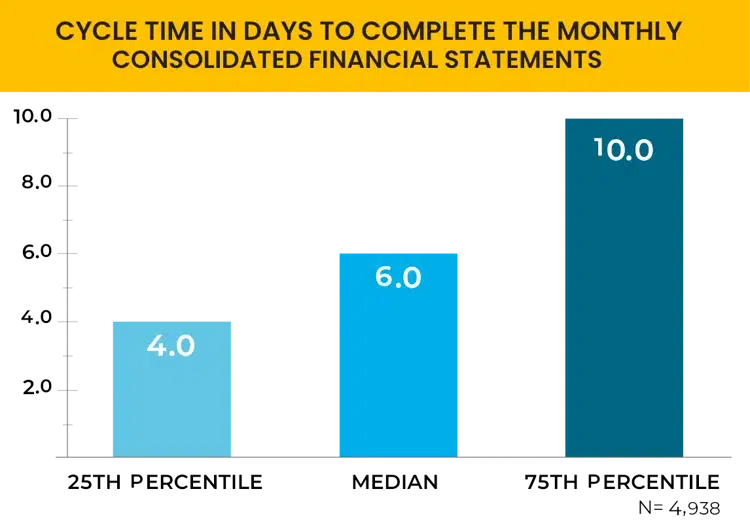

While APQC (American Productivity & Quality Center) benchmarking data indicates the process should take 3-5 days, 25% of Finance teams say it consumes 10 or more.

Our client’s month-end close is complex: 12 global subsidiaries perform individual closes on 8 different ERP systems that must be consolidated into a single financial statement by the corporate Finance team. At 7 days, the client’s cycle time for completing its monthly consolidated financial statement exceeded the industry best practice of 4 days, according to APQC.

The median cycle time for completing monthly consolidated financial statements is 6 days, according to APQC.

The client’s Finance leadership planned to implement technology enablers to optimize the process. But inefficient steps led to low levels of innovation and capacity for change.

The process also lacked scalability, systematic controls, and visibility into local financial close and reconciliation activities.

Key pain points included:

- Extremely manual processes caused a high risk of errors and inefficiencies that increased cycle times. For instance, pulling data from subsidiary General Ledgers was a tedious, manual process with a high potential for mistakes in most subsidiaries. The client also relied on Excel-intensive processes for complex activities like revenue recognition accounting entries calculation and revenue reporting for the board package.

- Activities relied on tribal knowledge, with no standardized or properly documented processes.

- Knowledge was siloed to individual sites and functions, without an understanding of upstream or downstream work.

- Current volumes and activities stretched teams, limiting their capacity to absorb additional scope or activities.

- Lack of time and technology enablers limited analytical work. For instance, the manual effort required to meet closing timelines and limited reporting tools minimized the ability of subsidiaries to perform important variance analyses.

- The manual nature and level of detail available in the current process prevented corporate teams from tracing back numbers. Corporate teams also lacked visibility into activity progress and had limited visibility into supporting documents at the local level.

- No systematic enforcement of controls. For instance, there were no levels of authority or standardized format for the Chart of Accounts (COA) across subsidiaries. APQC recommends COA centralization and standardization as a top strategy for decreasing consolidated financial statement cycle times, ensuring consistency in key data elements and lead times that prevent different business units from continuously adding new accounts.

Solution & Approach

This financial close consulting case study shows how Auxis helped the client solve these critical challenges. Auxis was hired to perform a financial close optimization assessment – analyzing the current month-end close and consolidation processes, identifying improvement opportunities, and recommending changes to improve data quality, automation, and internal controls.

With 25+ years of experience achieving peak back office performance for a wealth of Finance teams, Auxis came to the table with a proven methodology for optimizing processes to better address business needs.

Key solution steps included:

1. Reviewing month-end close and consolidation processes.

- To maximize efficiency and cost savings for the client, Auxis started its assessment with a thorough analysis of the month-end close processes at one U.S. and one international subsidiary. Strategic interviews and business walkthroughs examined systems and interfaces, COA, manual journal entry processing, accruals, intercompany reconciliations, closing of subsidiary systems and modules, and more.

- Once those processes were documented, the Auxis team performed a gap analysis with other subsidiaries – conducting high-level interviews to capture differences in their processes.

- Finally, Auxis reviewed and documented the consolidation process performed by the centralized corporate Finance team. The deep dive probed the COA governance structure, data collection and integrations with other locations, reporting visibility, intercompany eliminations, and preparation of consolidated financial statements.

2. Identifying improvement opportunities.

With current-state processes fully documented and understood and pain points identified, Auxis conducted workshops with client teams – working together to determine and resolve critical issues impacting the close and consolidation processes. To paint a clear picture of pressing business needs, challenges were divided into 3 categories: organization, process, and technology.

Besides optimizing process steps, Auxis Finance experts looked for opportunities to increase efficiency, productivity, and accuracy through automation.

3. Delivering an opportunities matrix and financial close optimization roadmap.

- Auxis delivered a matrix that recommended 46 opportunities for optimizing the client’s close and consolidation processes.

- To help the client assess value, Auxis categorized opportunities as “process improvements” like automation or “control gaps” that mitigate risk by improving governance and/or compliance with accounting principles.

- An important value of working with Auxis Finance experts stems from their ability to assess the risk level vs. benefits vs. complexity of improvement opportunities and prioritize implementation for the client. Recognizing that the client also planned to add a long-term tool to facilitate financial consolidation, Auxis built an implementation roadmap that identified short-, mid-, and long-term improvement opportunities and technology needs. Auxis also provided explanations of the analysis for the client to guide its path forward. For instance, short-term improvements range from implementing an automated task manager and reconciliations solution to standardizing the COA across subsidiaries and centralizing its approval. Mid-term opportunities include implementing the consolidation tool and standardizing/automating the contract review process. Long-term improvements are the most complex; for instance, reducing the number of ERP systems across subsidiaries and optimizing the AP function with an OCR (Optical Character Recognition) solution and vendor master data cleansing.

- Auxis prioritized 10 key opportunities for achieving quick wins, explaining recommended steps, benefits, and effort level required.

Results

Auxis’ financial close optimization assessment delivered a deep understanding of challenges that prevent the client from achieving top performance in its month-end close and consolidation processes – and a clear path for executing improvements.

Implementation of recommended short-term initiatives has already begun, such as COA standardization.

Key benefits of the Auxis assessment include: