In various press releases, the Federal Deposit Insurance Corporation (FDIC) has highlighted that an estimated $16.3 billion of the total cost incurred from the failures of Silicon Valley Bank (SVB) and Signature Bank was designated for safeguarding uninsured depositors. This financial strain emphasizes the critical need for effective regulatory oversight.

Immediately following the Silicon Valley Bank (SVB) failure, Perficient’s Financial Services Risk Management and Regulatory Capabilities Center of Excellence (CoE) swiftly analyzed publicly available documents, providing readers with a comprehensive breakdown of the bank’s failure. Despite this proactive approach, federal banking regulators either neglected to review the same documents or did so without taking necessary action before the bank failed.

Explore our detailed analysis in Perficient’s article on the causes of the failures: 7 Possible Causes of SVB Failure and Predicting the Impact on Regulatory Reporting

Assessment Base for the Special Assessment

Turning to the FDIC’s response, they have recently announced a Robin Hood-style special assessment, targeting large banks to contribute a premium for an Insured Depository Institution’s (IDI) estimated uninsured deposits as of December 31, 2022. This initiative aims to exempt the first $5 billion of IDI’s uninsured deposits, presumably shielding smaller bankers, especially in an election year.

The secondary special assessment will be levied at an annual rate of approximately 13.4 basis points over eight quarterly assessment periods. Commencing with the first quarterly assessment period of 2024 (i.e., January 1 through March 31, 2024), larger banks will be expected to remit payments by June 28, 2024.

SEE ALSO: Risk Management in Financial Services

Covered Entities

Covering 114 banking organizations, the FDIC’s estimate includes 48 with total assets exceeding $50 billion and 66 with assets ranging between $5 and $50 billion. Notably, these entities will bear more than half of the special assessment burden, underscoring the consequences of regulatory lapses in properly supervising the banks under their purview.

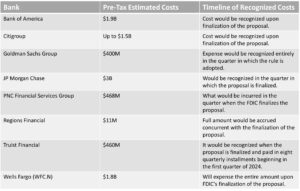

Certain large banks have publicly announced the estimated impact of the special assessment which the CoE has provided in the table below:

Together these banks would be paying more than half of the special assessment, which was caused by the regulator’s failure to properly supervise the banks they were supervising.

Unlock Perficient’s Financial Expertise

As your expert partner, Perficient invites you to engage in discussions addressing your specific risk and regulatory challenges.

Our unparalleled financial services expertise, combined with digital leadership across platforms and business needs, empowers the largest organizations to overcome complex challenges and foster compliant growth.

Contact us today to navigate the evolving landscape of risk and regulation successfully.