QuickBooks Desktop for small and mid-sized businesses

QuickBooks Desktop is a flexible accounting software application designed for small to mid-sized businesses. While the desktop application cannot complete with custom-designed ERP applications, many larger businesses have continued to use QuickBooks Desktop applications for their bookkeeping and accounting needs.

QuickBooks Desktop was first introduced in 1998 and modeled after Intuit’s first financial application, Quicken, which provided personal accounting capability, but no double-entry accounting. When QuickBooks Pro was initially introduced it was aimed at the non-accountant small business owner looking for a way to do accounting other than an Excel spreadsheet. In 2000, additional features were added to the application, but it still lacked the specificity that many small business owners were looking for.

That all changed in 2003 when Intuit introduced the first industry-specific editions of QuickBooks, which have grown in popularity and are now available in several editions, including the professional services version, which we’ll talk about in this article.

What is QuickBooks Desktop Professional Services?

While all niche industries can make an argument for an application designed specifically for their business needs, the professional services industry offers several challenges that need to be appropriately addressed including solid time tracking capability, flexible billing rates, and the option to better track project data.

QuickBooks Desktop Professional Services does that and more. Designed for those providing services rather than selling products, the Professional Services edition is available in both the Premier and Enterprise versions of QuickBooks Desktop.

In this article, we’ll take a look at QuickBooks Enterprise for Professional Services, which is designed for mid-sized businesses and can support up to forty system users. However, if your business has less than five QuickBooks users, you may want to consider using QuickBooks Premier Professional Services, a better option for smaller businesses.

Today, QuickBooks Enterprise Professional Services is loaded with features, including all those found in regular QuickBooks Desktop applications, such as double-entry accounting, online banking, bill payment, and invoicing. But it also includes features and functionality designed specifically for service professionals. Here’s a breakdown of some of the latest features.

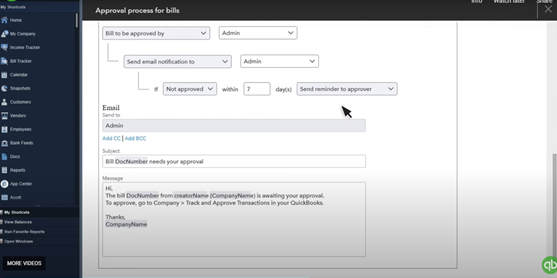

* Bill Workflow Approvals – (Platinum version) Bill workflow approvals is a brand new feature that allows you to better manage your cash flow by creating customizable workflow approvals. This new feature also includes reminders when approval deadlines approach.

You can set up custom workflows with the new Bill Workflow Approvals feature.

You can choose the custom workflow to suit your business, and can even customize the email message that the assigned recipient will receive. You can also choose whether you wish to copy anyone on the email. Once a workflow process has been set up for a particular vendor, whenever you enter a bill for that vendor, you will receive a message that the bill needs approval.

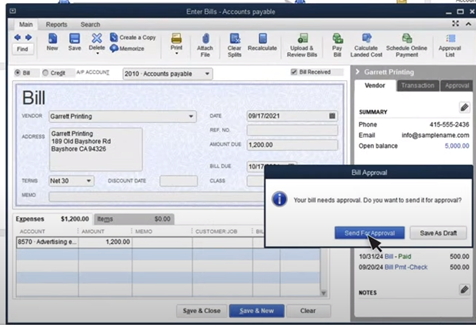

The Bill Approval option appears when a custom workflow has been set up for that vendor.

This message serves as a reminder that the bill has to be submitted for approval before processing.

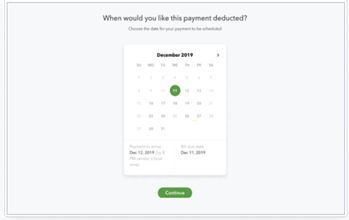

* Scheduling and Paying Bills – Another new feature in QuickBooks Enterprise Professional Services is the option to schedule bills for payment. A particularly useful feature for

smaller businesses with limited cash flow, using the billing scheduling and payment feature allows you to review any open balances, track sales orders, and plan in advance when to pay a bill.

The Scheduling and Bill Payment feature allows you to schedule bill payments.

When scheduling a payment, you have the option to choose the form of payment you wish to use including bank transfers or a physical check.

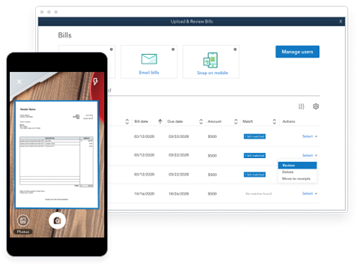

* Upload Bills to QuickBooks – Using the QuickBooks Desktop mobile app, you can now upload your bills directly into the application.

Using the QuickBooks Desktop Mobile App, you can easily upload bills.

All you have to do is snap a photo of the bill and click on the import feature. You’ll be able to review the bill for accuracy before it posts into your account. Another benefit to using this feature is that you can have your vendors email their invoices directly to QuickBooks, where they will be available for you to review.

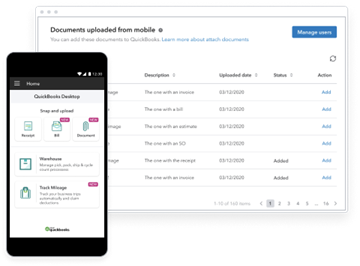

* Attach Documents to Transactions – Along with uploading invoices, you can also attach documents to any transaction using the mobile app.

Use the QuickBooks Desktop Mobile App to attach documents to any transaction.

Doing so eliminates the need to store multiple documents on your system. You can also upload and attach multiple documents simultaneously if desired.

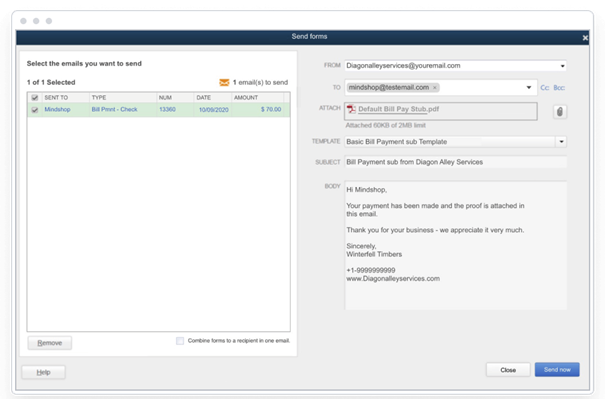

* Customize Bill Payment Stubs – Your vendors no longer have to wait for a paper check to receive a bill payment voucher. Using this feature, you can add your business logo and format the payment stub to suit your business.

You can now customize bill payment stubs for all of your vendors.

You can choose the vendors you wish from the dropdown list and create a custom email to send along with the bill payment stub.

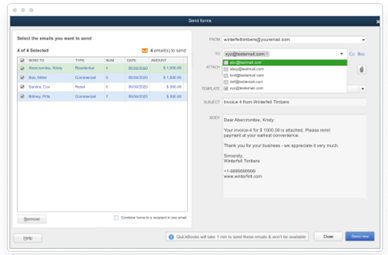

* Multiple Email Contacts – Do you have a newsletter, targeted sale, or other information you wish to send to a select group of contacts? Using the multiple email contact feature, you can do just that.

The Email Contact List allows you to choose the recipients for a group email.

This is a great way to get custom messaging out to the appropriate recipients without having to manually enter each email address.

The professional services industry offers several challenges that need to be appropriately addressed including solid time tracking capability, flexible billing rates, and the option to better track project data.

Other features

Along with these new features, QuickBooks Enterprise Professional Services also offers numerous features designed for professional services businesses. These include:

Time Tracking with QuickBooks Time Elite (formerly TSheets Elite) – Time tracking is important for any business, but particularly so for service businesses who have to manage timesheets and bill their time accordingly. Using QuickBooks Time Elite, professional services users can track time spent on any project. But even more important, the time can then be automatically rolled up into any subsequent project reports as well as into QuickBooks Payroll, eliminating the need to enter data twice.

This allows users to track their time from any location, whether it’s from their home, the office, or the client’s office.

Project Costing – It can be difficult to know if a client project is profitable if all of the project management components are not tracked properly. Not only can you easily track project cost projections in real-time using the job costing dashboard, but you can also track the actual expenses to see if you’re on track for profitability or if cost adjustments are needed.

Best of all, QuickBooks Enterprise will automatically create client invoices based on data entered in the system, eliminating the need to bill clients separately.

Flexible Billing Rates – As a professional services firm, your billing rates likely change frequently, depending on the job completed, who completed it, and the level of difficulty in completing the job. That’s why being able to assign different billing rates to your employees based on a variety of criteria is so important.

By setting custom billing rate levels, you can assign a rate for a particular level rather than by an employee. For example, at a CPA firm, partner billing rates would be assigned at a different level than entry-level employees.

Reporting – Good reporting options are available in all QuickBooks Desktop applications with the Enterprise edition of QuickBooks Desktop offering more than 200 reports that can be customized to suit your needs. Any customized report can be saved in the application as a template, so you can use the same reporting criteria in the future without having to set it up again.

Advanced Reporting – Advanced reporting allows Enterprise users to access raw data to create reports and graphs from scratch. In addition, the Professional Services edition of QuickBooks (and all niche editions) also offers bundled reports designed specifically for professional services businesses. These reports include:

- Billed and Unbilled Hours – This report can be run by person or by project, and provides management with a good view of all billable hours as well as how long an employee has spent on a particular project.

- Costs by Project – Costs need to be looked at throughout the life of a project. Running the Costs by Project report allows you to see exactly how much you’ve spent to date, allowing you to make adjustments to your forecast mid-project when needed.

- Project Costs Detail – Still wondering exactly why your project has gone over budget? Run the Project Costs Detail report to see exactly how funds were spent.

- Cost to Complete – Not sure if you have enough in the budget to complete a project? Just run the Cost to Complete report, which displays both percentage complete and cost to complete, allowing you to make any adjustments before the job runs over budget.

- Project Status – One of the most important reports for management, the Project Status report provides a summary view of all projects in progress along with a guide that shows you whether the project is on track for on-time completion.

Payroll Processing – All QuickBooks Enterprise editions come with QuickBooks Enhanced Payroll, which allows you to pay both employees and contractors. Enhanced Payroll also includes both printed check capability as well as free direct deposit. For those that want additional help with payroll, a subscription to Assisted Payroll will take care of all payroll taxes including filing and payment.

QuickBooks Enterprise Professional Services also includes a custom chart of accounts, can monitor project progress, track unbilled time, and electronically invoice clients. Multi-level data permissions are available, so management can establish permission levels for multiple groups of employees, ensuring confidentiality throughout the life of the project.

In addition, you can prepare custom proposals for potential business, accept mobile and credit card payments from your clients, and even integrate with Salesforce CRM for better client and sales management. For those that require integration with outside e-commerce channels, an optional e-commerce integration add-on is available that offers seamless integration with online stores and marketplaces.

Like all QuickBooks products, QuickBooks Enterprise Professional Services is designed to work on a Windows platform and is not currently available for Mac systems. Available as an annual subscription, Intuit offers three versions of Enterprise:

- Gold – The Gold version of QuickBooks Enterprise includes Advanced Reporting, access to QuickBooks Priority Circle, and QuickBooks Enhanced Payroll. The Gold version supports up to 30 system users and starts at $1,489.50 for the first year.

- Platinum – The Platinum version includes all Gold level features as well as Advanced Inventory for tracking inventory items, Advanced Pricing, and Bill Workflow Approvals. The Platinum version supports up to 30 system users with a subscription starting at $1,831.50 for the first year.

- Diamond – The most advanced version of QuickBooks Enterprise, the Diamond version can support up to 40 users and includes advanced features such as QuickBooks Time Elite, and the Salesforce CRM Connector. Diamond subscribers also have access to QuickBooks Desktop Assisted Payroll. The Diamond version of QuickBooks Enterprise starts at $3,618 the first year.

All subscription levels include customer support, online data backup storage for all QuickBooks data, product upgrades, and training tools.

Is QuickBooks Enterprise Right for Your Business?

A great option for mid-sized and growing professional services businesses that are looking for a better way to manage project costs and billing, QuickBooks Enterprise Professional Services is an all-in-one application that you will not soon outgrow.