Are you looking to supplement your Oracle EPM applications with enhanced analytics capabilities?

If you find yourself trying to achieve one of the following, this blog post introduces you to a Perficient solution that leverages the Incorta Direct Data Mapping technology.

- Mash up EPM data with data from other systems like ERP, Sales, etc…

- Drill down from EPM summaries to journals and transaction level details

- Reconcile your EPM summaries against various source systems

- Expand your horizon beyond EPM reporting capabilities and achieve modern-style analytics

Perficient has partnered with Incorta to provide integrated dynamic reporting across both Oracle EPM and ERP sourced data sets. The Incorta Oracle EPM Connector enables direct connectivity into Oracle EPM applications. Perficient’s Incorta blueprint enables you to leverage the Incorta EPM Connector to not only import EPM metadata and data into Incorta, but also model it together with ERP sourced detail transactions, such as General Ledger Account Balances, Journal Lines and Sales Invoices. The coexistence of EPM and ERP data sets in Incorta enhances financial reporting by providing richer insights across several financial applications.

How can Incorta Supplement Oracle EPM Reporting?

Following are some of the key benefits available in Perficient’s Incorta blueprint for financial analytics.

- Drill down from EPM consolidated account balances sourced from Oracle Financial Consolidation and Close to ERP application specific General Ledger balances and journals. The Incorta semantic modeling layer covers multiple ERP source applications together with the consolidated EPM financial results. Consequently, one can drill down from a consolidated EPM Account balance to reconcile it against GL balances and journals sourced from one or more source ERP systems. With Incorta’s scalability to handle billions of rows, there are no limitations when it comes to reconciling EPM account summaries to ERP General Ledger journal lines consisting of large data volumes.

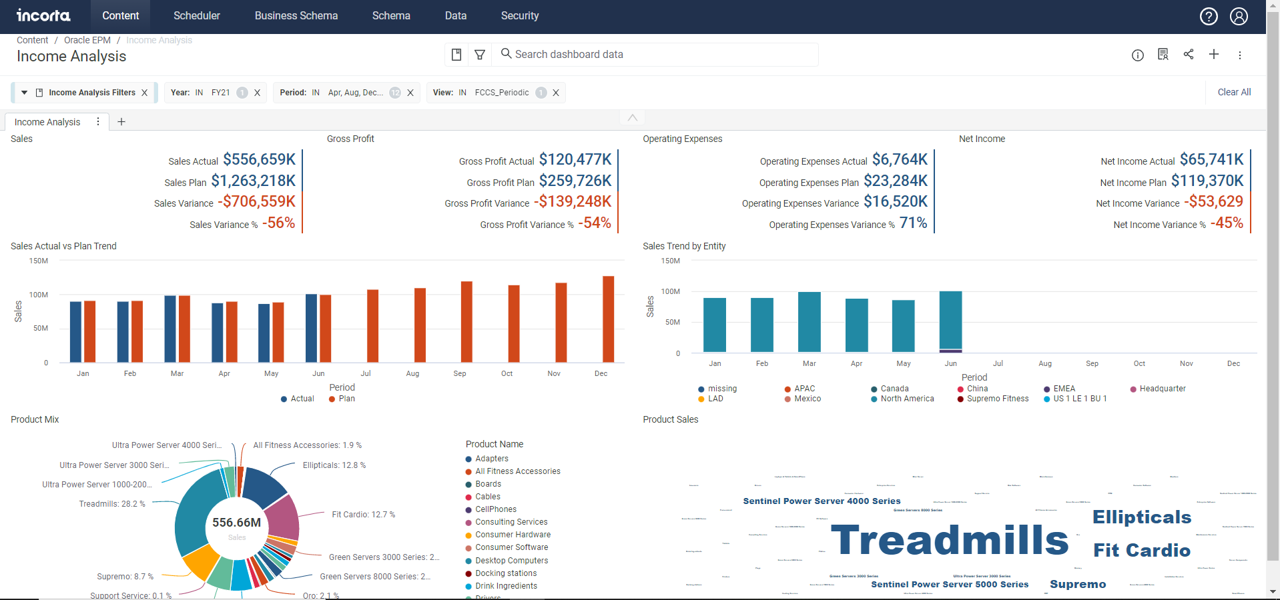

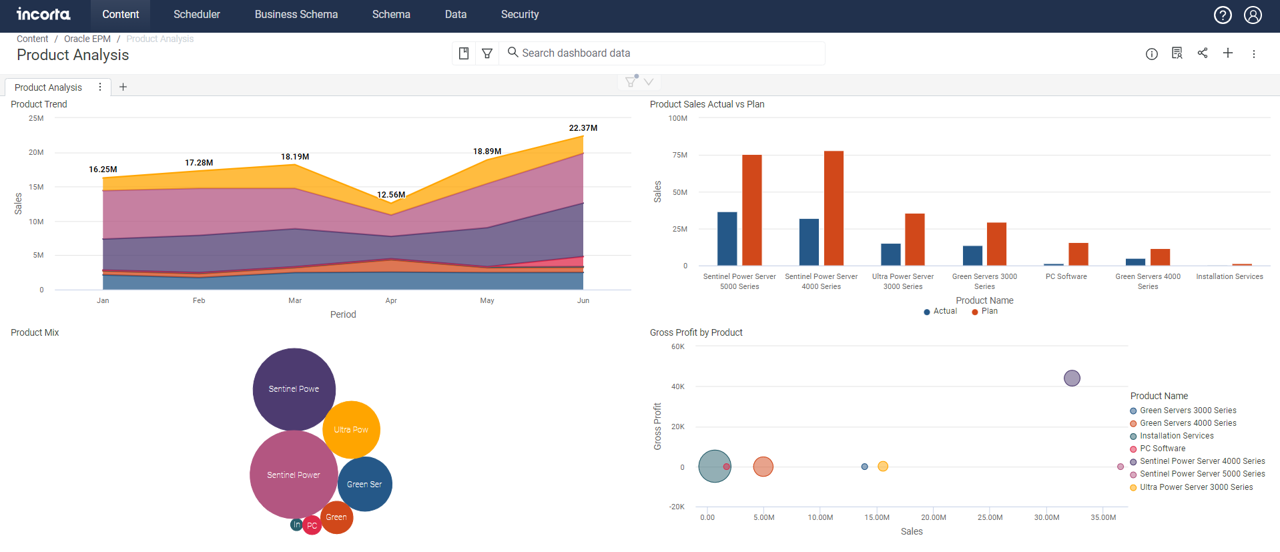

- Compare actual sales from ERP receivables to EPM budgets and forecasts maintained in Oracle Planning and Budgeting. Often times there is a need to track revenue or spending performance on a more frequent basis than what is maintained in the EPM Planning application. With the Incorta blueprint, we are able to track sales performance in comparison to plans defined in EPM, on a near-real time basis. The Incorta model provides a comparative analysis of up to the hour actuals, sourced from one or more ERP systems, with respect to various planning scenarios defined in EPM.

- Obtain deeper insights by drilling down from EPM financial summaries into more granular levels of detail that only exist in the source ERP systems. While financial information maintained in Oracle EPM provides a high-level view of financial performance results, it doesn’t cover a detailed analysis of various aspects of your business, such as customer specific characteristics or Item/SKU level of detail. Perficient’s Incorta-based dashboard solution offers seamless navigation from an EPM financial summary to transaction level detail sourced from ERP sub-ledgers. For example, when comparing income variance to plans and forecasts, you will be able to drill down to invoice details to identify drivers of profitability on a granular level. For instance, this will help identify which product or service offerings, or what groups of customers are contributing to higher and lower revenue and margin.

Implementing Incorta for Oracle EPM and ERP General Ledger and Sub-ledger reporting delivers several other benefits as well:

- Consolidated reporting against large volumes of data, such as invoice lines and multi-year historical analyses

- Dynamic reporting that enables multi-scenario comparisons and interactive drill-throughs to detail

- Point-in-time financial reporting (such as MTD, QTD & YTD) and compare against prior periods, budgets and forecasts throughout the month, and not just after completion of monthly close and consolidation cycles

- Easy access to critical reporting on financial operations like GL to subledger reconciliation, intercompany eliminations, manual journal entries, unapproved invoices, etc

- Automated alerts on KPIs that are deviating from expected benchmarks

- Secure access to up-to-date financial information on mobile devices

To get a closer look at this solution and see a live demo of the Incorta dashboard, you may reach me at mazen.manasseh@perficient.com.