AI for Risk Management Cheat Sheet: How to Nail It

artificial intelligencebusinesscloud computingmachine learningBorrowed mind. That’s how Nikola Tesla, well-known for his work on electricity, described the power of his radio-controlled boat. And 123 years later, we’re still in awe of the “borrowed mind” phenomenon. However, now, as a surprising and marvelous creation, we have AI instead.

Artificial intelligence is one of the most influential technologies of our time. It can make you more productive, reduce your costs, and automate mundane tasks for you. But what’s with risk management? What are the benefits and risks of artificial intelligence implementation in this domain?

Do you want to enable better risk management and disable the risks of artificial intelligence itself? Then dive into this guide. We’ll look at AI for risk management use cases, benefits, and challenges.

3 main points on AI in financial services

#1: What’s artificial intelligence?

Let’s agree with the definition of artificial intelligence first. The thing is, we’re not talking about xenomorphs or E.T. If you already know the difference between real and commonly believed AI, you can skip this section and go to the next one.

AI is a collection of techniques like machine learning, deep learning, speech and visual recognition, natural language processing and understanding.

These techniques usually deal with:

- Massive data sets;

- Non-traditional data sources;

- Models with quickly shifting timeline topologies;

- Black-box model that generates useful output without any knowledge of its internal workings.

Thanks to that, AI boosts analyzing existing data to identify patterns and behaviors that may predict future actions.

For example, AI helps when you’re puzzling about the next movie to watch on your favorite video streaming app.

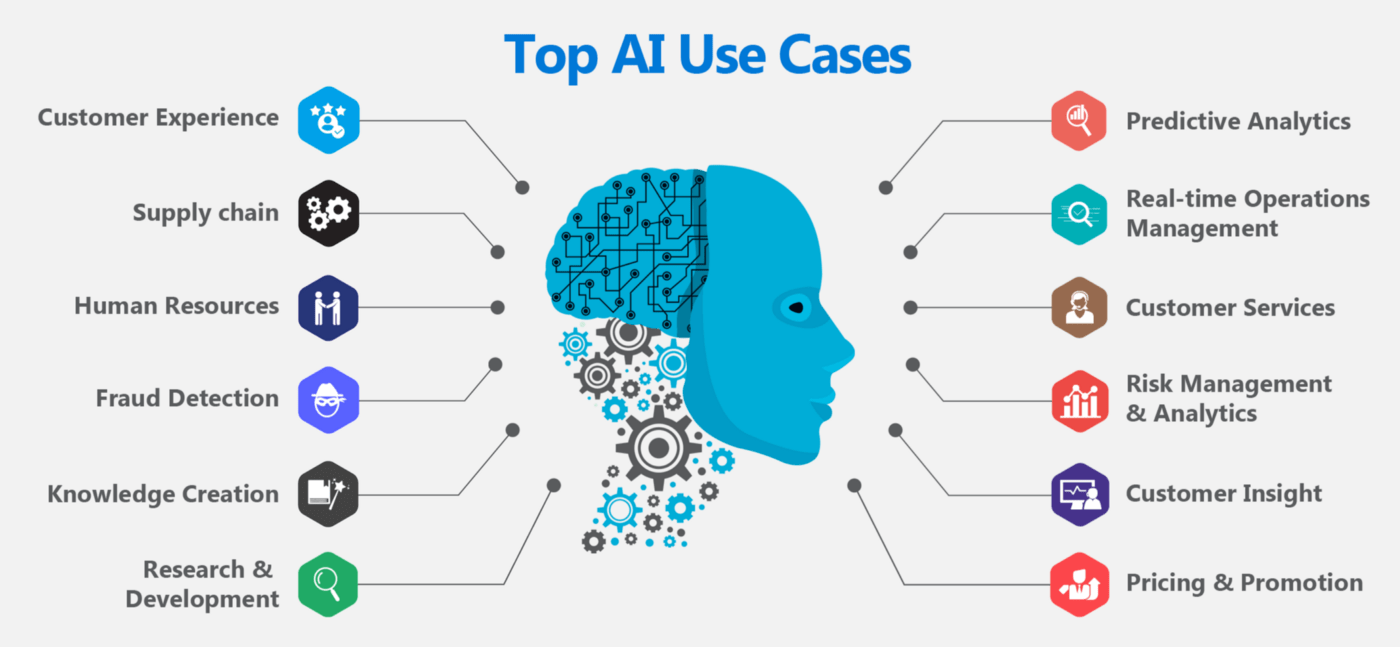

AI is on the verge of revolutionizing the way organizations operate. Marketing, customer service, training, pricing, security, operations. These are just a few of the areas where data is already being used to optimize performance.

As a result, competing with existing and digitally native market entrants may be tough. That’s why companies in almost every industry will need to put in place AI and agile development methodologies that enable smooth work with it. They must, however, do so while balancing the new risks artificial intelligence poses.

Machine learning can handle large volumes of data in real-time and examine innumerable variables. Therefore, it’s far superior to humans for specialized tasks. Also, it can uncover important correlations that we would never see.

#2: Risk management: How to secure your business

Every business faces plenty of uncertainty and risk. Risk management is the process of discovering, evaluating, and managing threats to an organization’s profitability. The most popular threats arise from the following sources:

- Financial uncertainties;

- Legal responsibilities;

- Strategic management failures;

- Accidents;

- Natural disasters.

You can’t prevent things you can’t predict

This straightforward definition highlights the most important aspect of worry: uncertainty. However, establishing the frequency or likelihood and the level of impact or severity is the actual problem.

Every business and organization needs to bear in mind unexpected harmful events that can lead to company losses. Threat management prepares for the unexpected by decreasing risks and extra expenses before it occurs.

Meanwhile, data-related and digital security threats are here to stay for almost any business. Strategies to alleviate such threats have risen to the top of the priority list for digitized businesses.

That’s why risk management continues to exploit threat management to protect the company’s digital assets. These include proprietary corporate data, customers’ personally identifiable information (PII), and intellectual property.

Organizations can save money and protect the future by developing a thorough risk management plan. Thus, they consider many potential events before they even occur. To be more confident in business decisions, organizations need to identify and manage risks.

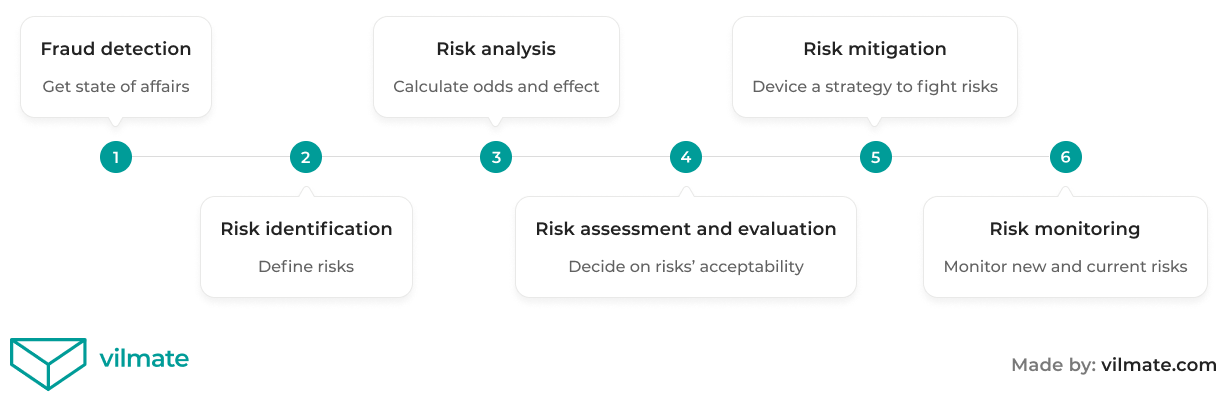

To sum up, let’s outline risk management strategies and processes.

So, we’ve learned what risk management and AI are. And now we’ll combine them to see if they match.

#3: Bringing AI into managing risks

We think anyone would agree that we exist in a complicated and fast-moving environment. That’s why traditional threat management techniques may not be the answer now. To achieve more, companies need to incorporate AI into their strategies from the start.

Firstly, AI and managing risks are an excellent match when it comes to processing and interpreting unstructured data. Also, AI solutions can provide companies with timely data for risk-handling strategies.

By using AI, risk managers can focus more on analytics and proactively halting losses based on machine learning insights. Also, controlling operational threats will cease to be such a big problem.

Secondly, AI has been widely used in credit risk management. Credit risk is one of the most significant risks for a financial institution. That’s why an increasing number of businesses are looking for solutions to address it.

Also, in financial services, artificial intelligence algorithms that identify fraudulent transactions are broadly used. Due to that, it’s now possible to create AI systems that allow both customers and sellers to act quickly when a potential problem occurs.

Machine learning can detect a critical risk indicator and forecast when it’ll reach undesirable levels. They also employ AI to automate the distribution of these forecasts in ways that people can understand.

Thanks to predictive analytics and natural language processing, AI-powered threat management can handle the question of credibility. It gives you a lot of insights that people can’t get because of the restrictions of human computational capacity.

AI for risk management: What do you get?

The fintech industry is already bearing fruit from AI solutions. Frequently, artificial intelligence in financial services relies on the cloud’s mass computing capability. Thus, such solutions can quickly evaluate and process vast amounts of unstructured data.

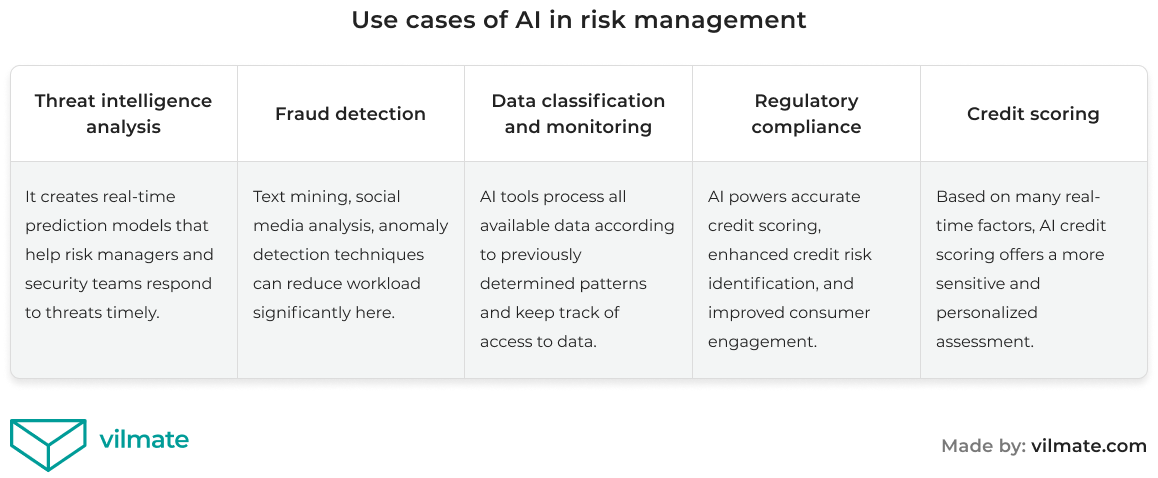

Below, you can find some examples of specific use cases that have benefited from automatization.

Now, we have an understanding of what artificial intelligence in financial services can do. So, let’s find out more about artificial intelligence opportunities and risks.

Managing risks with AI: Pros and Cons

Pros

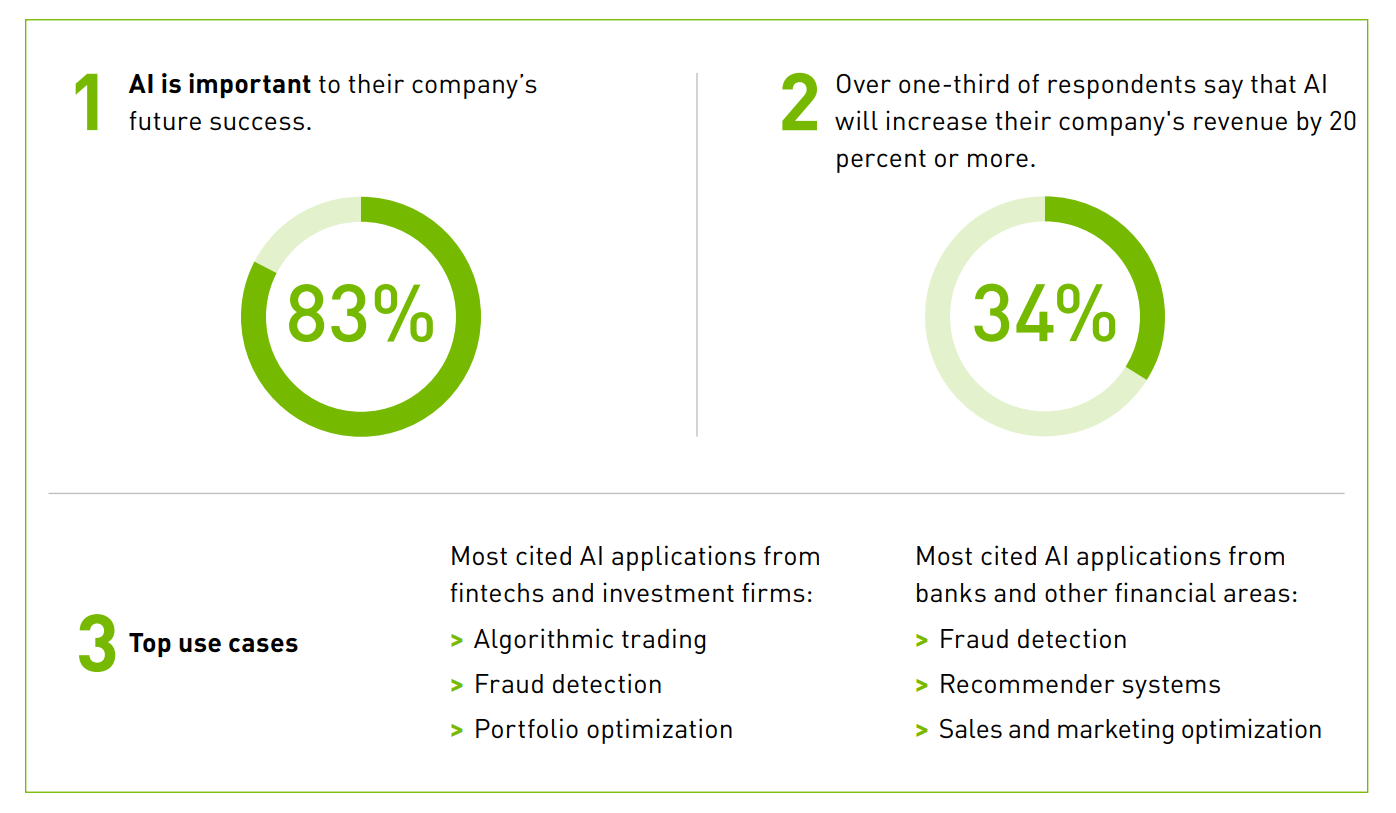

Nowadays, the globe is undergoing fast digital transformation. Consequently, AI is becoming a rising force in healthcare, education, marketing, retail, and finance. According to Forbes, expanding available data and AI capabilities force financial firms to get an AI strategy. Or they will face the risk of falling behind their more digitalized rivals.

NVIDIA polled financial services workers, and 83% felt that AI was critical to their organization’s future success. 81% of those polled were from the C-suite. See other keynotes from the survey below.

AI-powered risk-managing technologies are frequently integrated into security automation procedures. They can be of great help during incidents, business continuity planning, and fraud investigations. Decisions that were earlier made “on instinct” or by benchmarking will become data-driven and structured.

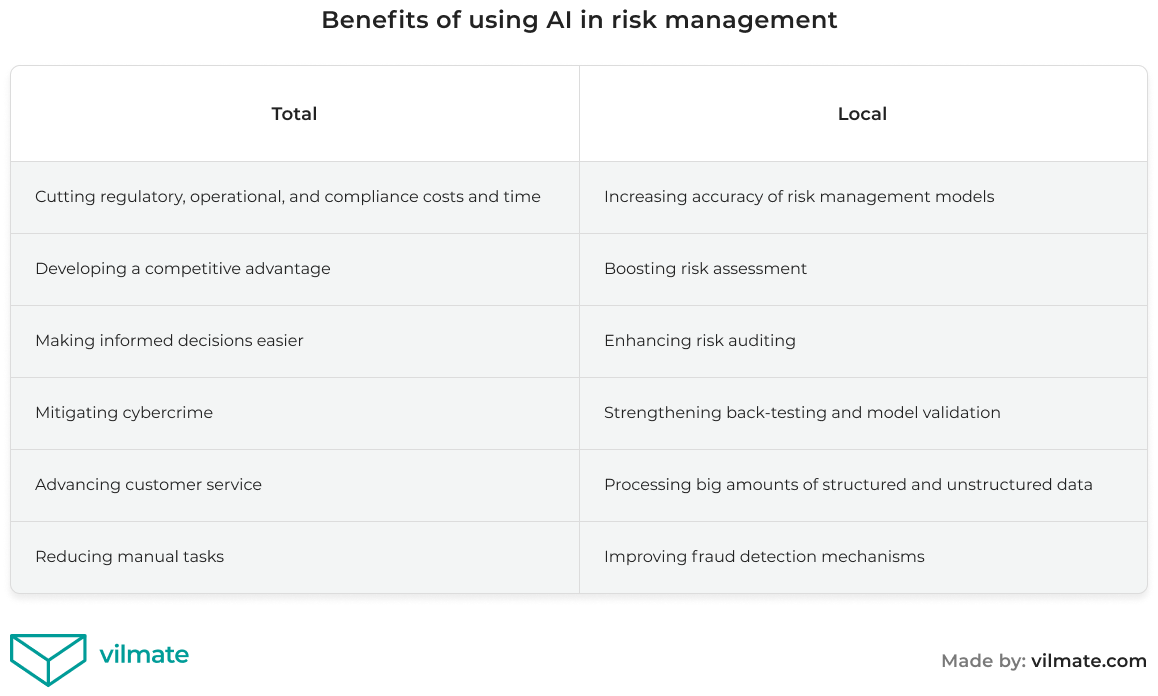

To sum up, we gathered the benefits of using AI for risk management in the table below.

Cons

We’ve learned about the advantages of using artificial intelligence in financial services. But we also need to understand that it has its dark sides too.

So what are the risks of artificial intelligence? Let’s take a closer look.

- Cost

The first consideration is cost. Processing massive amounts of data, especially when employing cloud-native services, can be costly. Also, specialized AI services might potentially be expensive to implement.

- Privacy

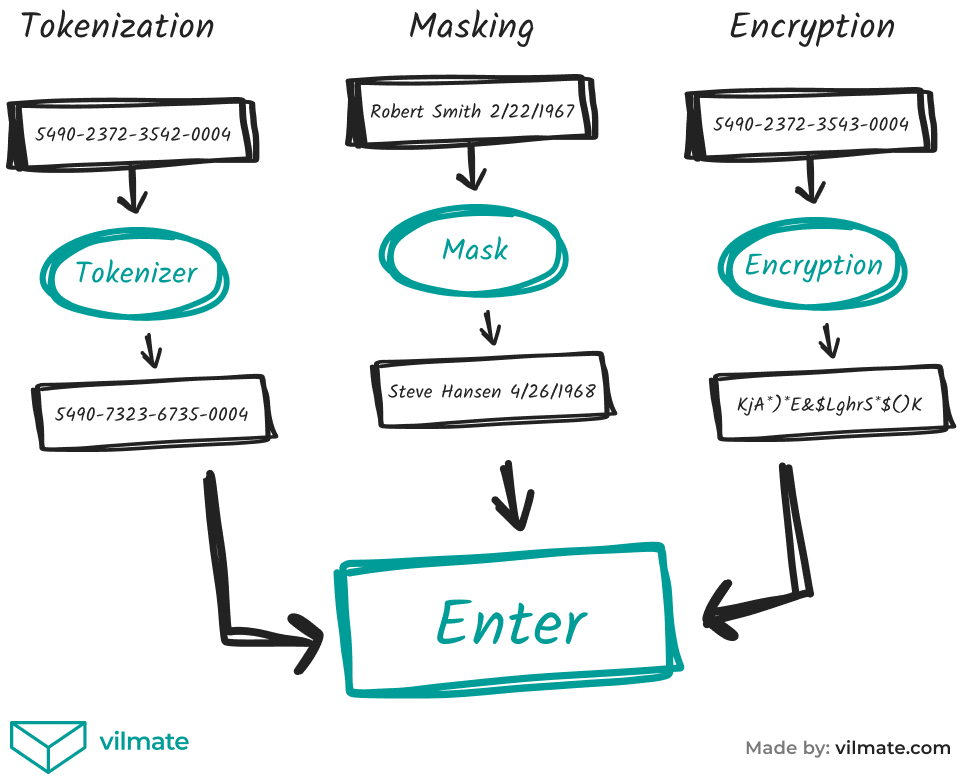

The second consideration is privacy. Data privacy sparks concern as AI becomes more prevalent. However, you can implement data protection controls, such as obfuscation.

Below, you can find 3 main obfuscation methods: tokenization, masking, and encryption.

Misuse of data in the fintech industry frequently leads to substantial losses. That’s why security improvements must go hand in hand with the growth of artificial intelligence in financial services. A big step forward in terms of regulations was the implementation of GDPR in the EU zone.

- Technological complexity

Two main roadblocks to AI adoption are the skills shortage and the availability of technical staff. Now the market lacks experienced specialists that deploy and operate AI solutions effectively.

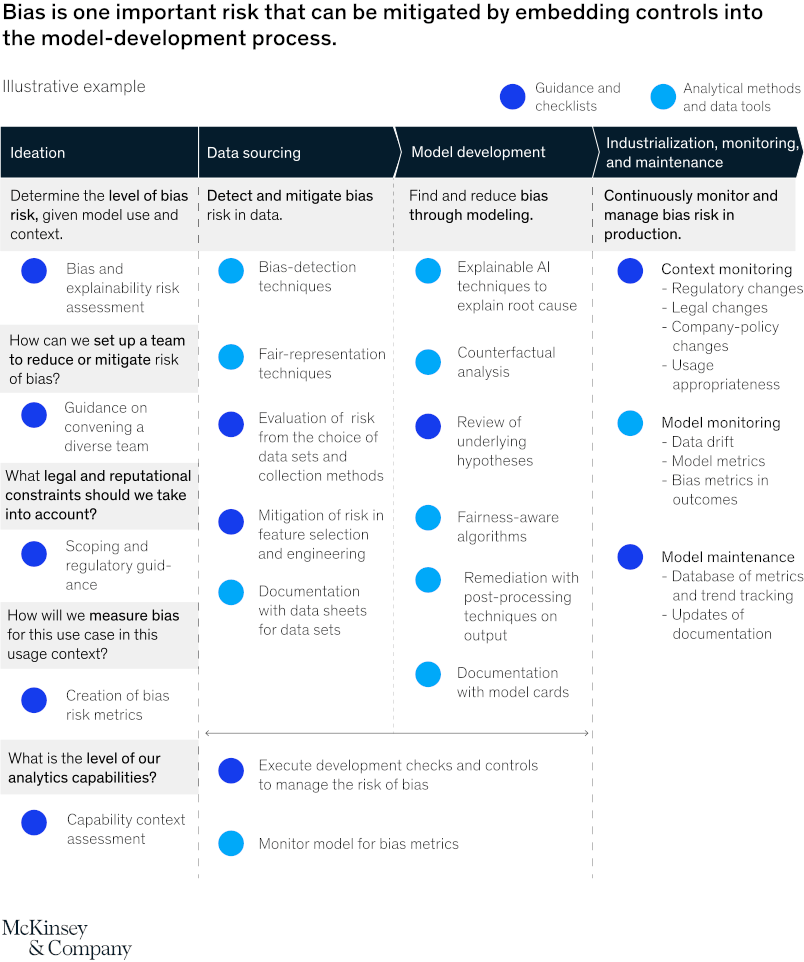

Another concern of this technology is that, like humans, AI may be influenced by bias. Without adequate human oversight, an algorithm might generate discriminatory predictions.

However, an excessive human intervention doesn’t make it sound better. Likewise, improving model performance by engineering input variables isn’t the best technique. It can accidentally cause a model to favor particular outcomes that do not hold up over time.

To take care of such problems, you need to include appropriate benefit-risk trade-offs in model designs.

But what other techniques and methods one can implement to maximize the benefits of using AI for risk management? Let’s find out.

How to get the most when managing risks

We know already that artificial intelligence in financial services implementation can be challenging. But nowadays, the market can boast of some examples of successful implementation of AI for risk management.

The investment bank JPMorgan Chase has created the COiN (Contract Intelligence) platform. It’s meant to analyze legal documents and extract relevant data using machine learning and natural language processing. The platform analyzes hundreds of business agreements in seconds. As a result, back-end procedures take substantially less time.

AI-powered risk-managing platform completed 360,000 man-hours in seconds.

Framework for using AI in financial services

To achieve amazing results like this, you’ll need to adopt a specific process for using AI. You may use the following process suggested by the McKinsey management consulting firm. It’ll help you mitigate the risks of artificial intelligence and make the most out of the benefits it provides.

Final words

Digital transformation continues to change the world we live in. And we see that artificial intelligence is finding its way into many fields, including risk management.

AI boosts the efficiency of operational processes, improves data management, and facilitates decision-making. That’s why many experts consider AI for risk management as a game-changer. It’s expected to significantly change the risk management domain as it will become more mature.

Are you interested in modernizing the risk management domain with AI software solutions? Then contact us to get a free quote. Vilmate has been delivering robust software development projects for more than 9 years. Also, we’re not novices in developing compliance management software, so you can depend on our track record.