Practically any business discussion ends up with the question: ‘I’m sorry, but how much will it eventually cost?’ Despite that, money can’t be considered a typical resource. Unlike physical materials, fuels, or even human labor, money carries a symbolic make-believe value, serving merely a tool.

The price for goods and services is usually formed in response to the ever-shifting context of our reality. For this reason, banking and other related spheres of financial services are in need of adopting emerging digital approaches like no one else.

In this article, we’ll try to define the following ‘THEs’:

- The key difference between open banking and traditional one

- The benefits that APIs in banking hold

- The top challenge that any open banking company that uses APIs has to always be aware of

Open banking vs. Traditional banking

Going digital is inevitable for any sphere which is aimed at meeting competition and staying afloat. And banking is not an exception in that matter in terms of providing reliable financial services.

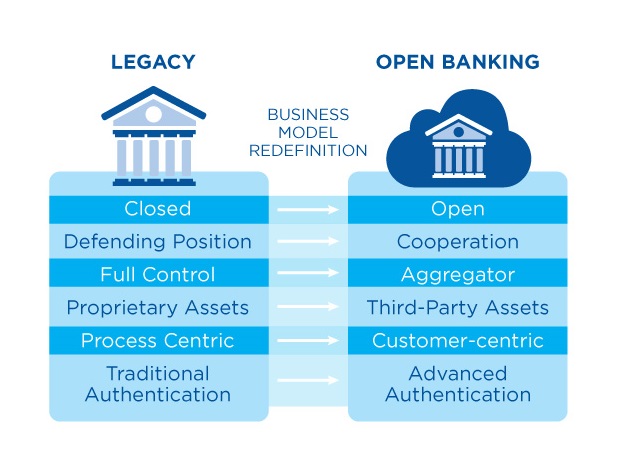

But even if a bank is presented online and provides digital banking facilities, it can still be called a traditional one if it falls down the following features:

- operates in a closed environment

- is more product than customer-centric

- puts forth the brick and mortar model

- acts within strictly regulated licenses

So how does open banking work?

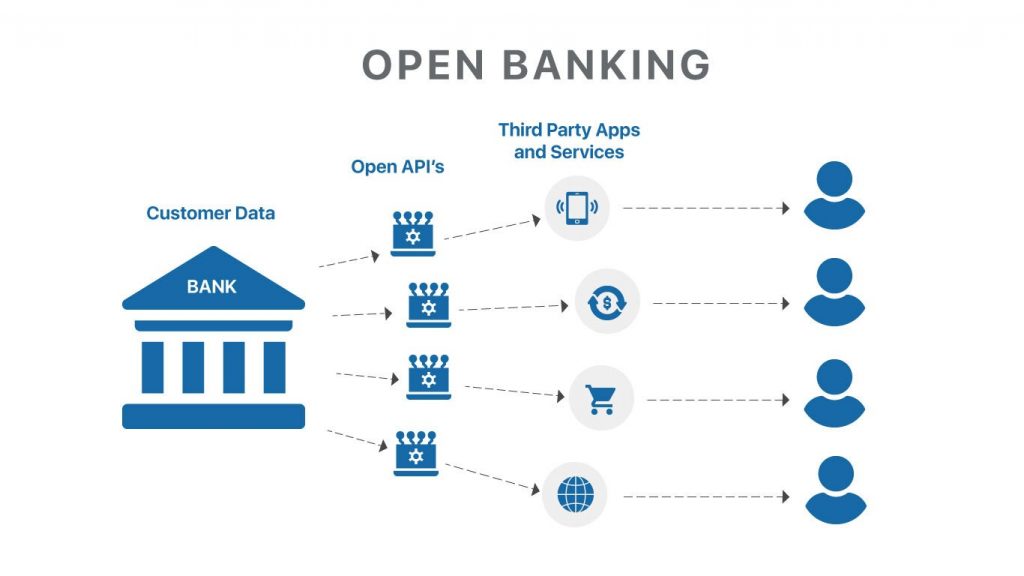

On the contrary, the open banking concept understands the ability of a user to pass their financial data to some third-party providers (TPPs).

Basically, you can allow your bank or any other non-bank financial institution to share your sensitive data with a stand-alone open banking platform, application, or any other open banking company. Sounds scary. Though, don’t be hasty in judgement.

This kind of approach is able to redefine the whole model of the banking business and improve the core practices of consumer-provider communication.

Before moving on, let’s briefly cover another term that helps the industry to be reshaped and lifted to the next quality service level.

API in a nutshell

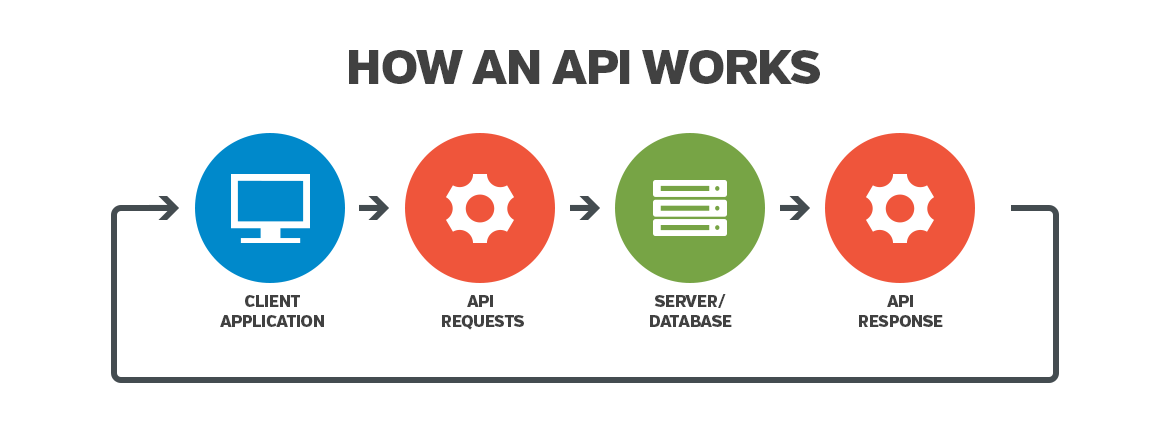

An application programming interface (API) serves as a connecting thread between various pieces of software. It is similar to a graphical user interface (GUI), though it’s closer to sharing the IoT concept.

Regarding end users, the main purpose of an API is to maintain interaction between endpoints such as servers and databases, hiding unnecessary details.

Various communication protocols, subroutines, methods, etc., make it possible and adjustable. All of that is typically described in a corresponding API specification.

In most cases, when building an API, it often requires more sophisticated architectural solutions than while developing a GUI. A back-end storage, well-thought-out logics, and automation tools are inseparable companions of a proper API.

However, to the greater part, it depends on the volume and purpose of a project, so the field for debate is infinite here.

How beneficial are banking APIs in fintech?

So what makes the open banking API so beneficial regarding fintech approaches?

Let’s say your investment portfolio is growing bigger – lucky you :). You’ve got several accounts in several banks, a couple of long-term deposits with progressive interest rates, a few short-term loans, and a pinch of shares from a dozen of promising start-up companies, well, just in case.

Even if all the related institutions have user-friendly applications and a perfect online support (though it sounds like a bit from a science fiction novel), you’ll end up having your smartphone packed. Seems like not such a big deal. But a huge scheme in your head for optimal surfing around those mobile banking applications will definitely cause inconvenience.

From the previous section, it becomes clear that APIs enable software and, ultimately, equipment to ‘have a conversation’ with each other. At any rate, it makes it possible to bind data from various points and project it onto a single viewport for a user in an appropriate form.

So let’s just cover all the fundamental advances, which are actually applied almost to any tech, one by one.

- Cost-effectiveness

Digital banking and open banking platforms can offer their services, excluding unnecessary steps like customers’ physical presence or interaction with the staff. API interfaces make the range of services of mobile banking wider with the reduction of the resources spent.

As for the consumers, the ability to customize banking experiences enables them to integrate their personal demands with a few simple actions, without having to pay any extra fees to an open banking company.

- Reduced request response time

It’s hard to call in question that there’s nothing more valuable than time. With a properly adjusted open banking API platform, one can instantly connect to various banking servers and retrieve the required data. Payment initiation services allow to make direct transfers between accounts via a single mobile device. Not mentioning the lack of necessity to contact each banking institution separately.

- Extended functionality

The agile nature of APIs allows developers to make their functionality really versatile. The range and specificity of mobile banking services may vary immensely. Luckily, an open banking API enables a customer to put them together in one place, leaving some space for adjustment.

- Personal involvement

The psychological aspect of being the real owner of your belongings, even digital ones, is no less important than anything else. Leaving out the technical details, the ability to manage your finances and data from an open banking platform personally would give the sense of confidence alongside the increased responsibility before making decisions.

The One challenge

The biggest challenge that a technology with the involvement of third-parties may face is, for sure, cybersecurity.

Taking into account that the finance sector has always been a honey pie for criminals, one has to be double alert about data breaches and potential security flaws.

Though, there’s no need to panic. A team of experienced security experts will reduce to the minimum the chance of an unwanted element to sneak into your system. And the implementation of such a thing as blockchain will let you sleep a peaceful sleep.

Moreover, despite being less regulated than traditional banking, fintech technologies still receive some governmental legal protection. Payment Services Directive (PSD2), introduced in 2015 in the EU, is a perfect display of that.

To sum up

- The fintech industry has been growing rapidly for the past few years, transforming business models, workflows, and the delivery of services in digital banking.

- Open banking platforms and the implementation of APIs in banking have made the picture more clear and transparent for users.

- The competition in the sector of digital and mobile banking has made another gulp of air, giving the consumers more tools for managing their finances and expanding investment opportunities.

These are only the manifest benefits APIs in banking offer. And the answer to the question ‘How far it may go?’ ‒ ‘The sky’s the limit!’

Don’t hesitate to check out some more information if you show interest in fintech applications. Also, don't forget to check our portfolio to see how Vilmate can help your business grow.