Payments are, obviously, an integral part of supplier and vendor relationships. If you pay too late or get an amount wrong, you could end up with high penalty fees or even having to switch suppliers as you’re trying to complete a customer order.

A robust accounts payable process helps you stay on your supplier’s good side and gives you a better overview of your company’s cash flow at all times. You also protect yourself against fraud from parties posing as vendors.

In this article, we’ll break down the accounts payable process, its importance, and common challenges. We’ll also look at how you can streamline it with process management software.

Want to skip ahead? Use the links below:

- What Is the Accounts Payable Process?

- What Is the 3 Way Match Process in Accounts Payable?

- Why You Need a Robust Accounts Payable Process

- Top Accounts Payable Challenges (in a Post-Covid World)

- How to Streamline Your Accounts Payable Process with Process Management Software

What Is the Accounts Payable Process?

The accounts payable (AP) process is how companies manage payments to suppliers and vendors for goods and services they purchase.

AP breaks down the ordering and payment process into four steps:

- Keep and catalog purchase orders (analog or digital).

- Receive invoices from suppliers based on goods or services rendered.

- Review the vendor invoices (with the three-way match process).

- Pay the invoices.

If you want to get specific, you can break it down further than that, but this is the core process.

Unlike the accounts receivable process — which is essentially about collecting owed payments from customers — AP focuses on “outgoing” cash flow, not incoming. It’s about managing the money spent on supplies from vendors you need to create new products or deliver services.

What Is the 3-Way Match Process in Accounts Payable?

The three-way match process compares all incoming invoices against the purchase order and receipt bill.

These three documents are the key to maintaining a secure and accurate accounting system:

- Purchase order: The receipt of your original order from the supplier or vendor.

- Invoice: Bill for services rendered or delivered goods.

- Receipt or receiving report: Document that describes the goods or services received.

They’re the standard internal controls your team goes through before confirming any vendor payment. Only after your team ensures a complete match do they process any payment.

For example, suppose you order a new supply of leather to finish a batch of bags. In that case, your company will accurately track every detail of the transaction, including invoice receipts and receipt confirmation for goods, and they’ll confirm that everything lines up.

That’s the essence of the three-way matching process in AP. An accounts payable department that masters this process can help reduce risks related to sizable vendor orders.

You can reduce the risk of fraud, improve your payment management and supplier relationships, and more.

Watch a 3m video of an automated PO workflow in frevvo.

Why You Need a Robust Accounts Payable Process

55% of executives say AP is very or exceptionally valuable to their organization. A robust AP process is crucial for maintaining healthy supplier relationships and protecting yourself from fraud.

Let’s look at why you need a strong AP process in more detail.

Build Healthy Supplier Relationships

77% of companies are investing in deeper supplier relationships. But at the same time, many companies don’t even pay their invoices on time.

30% of small businesses experience negative effects from late invoice payments — it’s one of their main concerns about doing business with other companies.

Always paying your invoices on time with the correct amount the first time around is the foundation of a strong supplier relationship.

Build rapport by never exceeding invoice due dates, making it easier to get special treatment when you need it — like fast handling on last-minute orders.

Protect Yourself Against Fraud

If you order a large volume of goods or services, especially digital services, maintaining the accuracy of every single minor transaction can be a challenge. Without proper bookkeeping, it’s easy to lose track and fall victim to fraud.

It even happens to the biggest companies in the world. Facebook and Google lost over $100 million to a single vendor fraud case, where a group of swindlers impersonated one of their suppliers.

By always comparing invoices to outgoing purchase orders and receipt reports and looking for discrepancies, you can avoid vendor fraud altogether. Your team will never authorize credit card payments for purchases that you never made.

And this is only one of many procurement risks AP can help with.

Get a Better Overview of Your Cash Flow

Not having a handle on your cash flow can be a costly problem, stopping your business from taking on new projects and growing. 52% of U.S. SMBs have lost a project of $10,000 or more because of insufficient cash flow.

By documenting all vendor transactions, you can estimate monthly expenses and make better decisions about cash flow. It also makes it easier to create financial statements like a balance sheet for your company’s shareholders.

Of course, manually tracking every company credit card in an excel sheet isn’t the most effective way to get things done. Instead, automated invoice processing can help you match, process, and log all payments correctly without painstaking data entry.

But it’s not at all smooth sailing. Accounts payable departments worldwide are facing a growing set of challenges in a post-pandemic landscape.

Top Accounts Payable Challenges (in a Post-Covid World)

Let’s look at some of the biggest challenges AP teams faced in 2020 and what you should do about them.

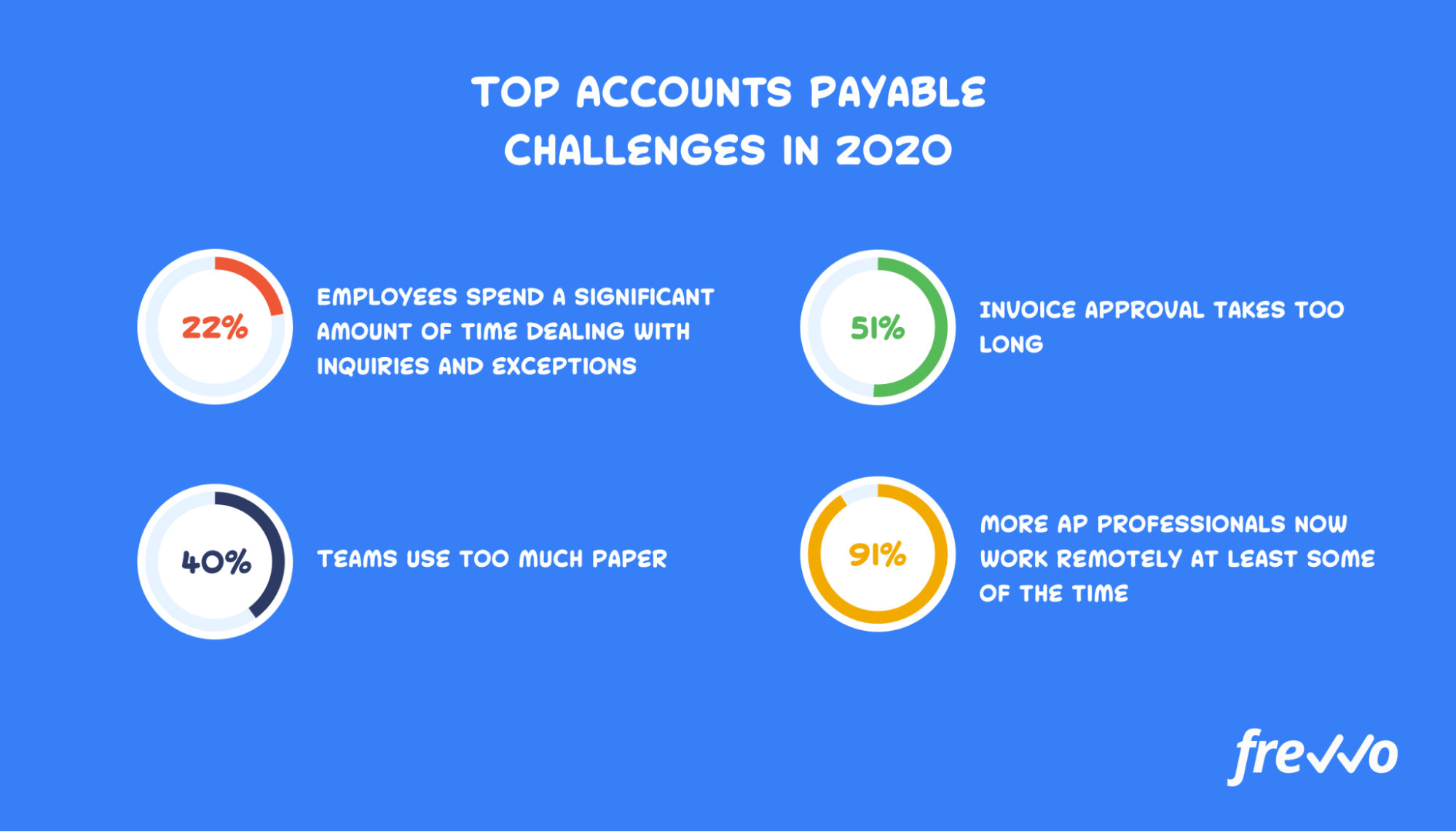

Working Remotely Is Becoming the New Normal

2020 was a year that changed the working lives of virtually every AP department out there. While traditionally most worked in the office, now 91% of AP professionals work remotely at least some of the time.

That comes with its own set of challenges, like effectively digitizing the process and finding accounting software solutions to invest in.

It also highlights existing issues, like a workflow centered around printed receipts and invoices and manually confirming all invoice data.

Supplier Inquiries and Invoice Exceptions

In 2020, AP employees spent 22% of their time handling supplier inquiries. They might need extra time to deliver a shipment, or they may not be able to deliver the full amount.

That means you need to change everything from the original purchase order to the invoice in order to ensure that your numbers match up later.

A digital process and accounts payable automation can make it easier for your team to adjust to these types of changes. They can quickly look up original orders and then confirm and make changes to data while on a call with the supplier — no need to comb through filing cabinets.

Using Too Much Paper

With an analog approach, you print at least three sheets of paper for every purchase order and item you receive — the order, receipt, and invoice.

4 out of 10 accounts payable teams feel they use too much paper, especially as companies face increasing pressure to become greener.

The solution is simple but not easy: going paperless (more on this below).

Invoice Approval Takes Too Long

51% of companies say that invoice approval takes too long. With the traditional manual review process of invoice data, who can blame them?

If your backlog builds up, that can lead to an overworked AP department — more prone to human error — delayed invoice payments, and worsening supplier relationships.

A slow process also increases your risk of breaking payment terms and incurring late fees.

One of the root causes for slow invoice approval is incorrectly-filled-out purchase orders that lack information. A manual process leaves you vulnerable to delays caused by human error.

While the global pandemic hasn’t left AP unscathed, many top challenges are still the same as they were before, like using too much paper or taking too long to approve invoices.

How to Streamline Your Accounts Payable Process with Process Management Software

Using process management software like frevvo, you can streamline your AP process from start to finish without coding any complicated programs from scratch.

You can even automate certain parts of the process to eliminate the risk of human error, increase efficiency, and pay more invoices on time.

Let’s take a look at how you should set this all up.

1. Create Digital Ledgers for Vendors and Suppliers

The first thing you need to do is create digital ledger accounts dedicated to all your existing suppliers. This will help the system automatically index and categorize purchase orders and invoices according to the data in the form.

In essence, this is how you organize your “digital filing cabinet” with a smarter AP process. Most companies already have some kind of general ledger set up in their ERP (enterprise resource planning) software.

The problem is that most companies try to maintain the data in their ERP with manual processes and data entry.

Instead, you should set up a digital process that automatically collects, stores, and even matches and validates invoices.

2. Handle Purchase Orders and Invoices Digitally with Custom Forms

Set up custom forms for vendors and internal teams to digitize your records, plus eliminate paper waste and time-consuming data entry.

With frevvo’s dynamic form builder, you can easily create purchase order forms that suit the needs of you and your vendors — without writing any code.

You can start with a template and quickly add all necessary fields to ensure your employees fill out the required data points for each purchase order.

This is the first step toward streamlining your ordering and invoicing process with automated form processing — next up, you need to automate your authorization workflow.

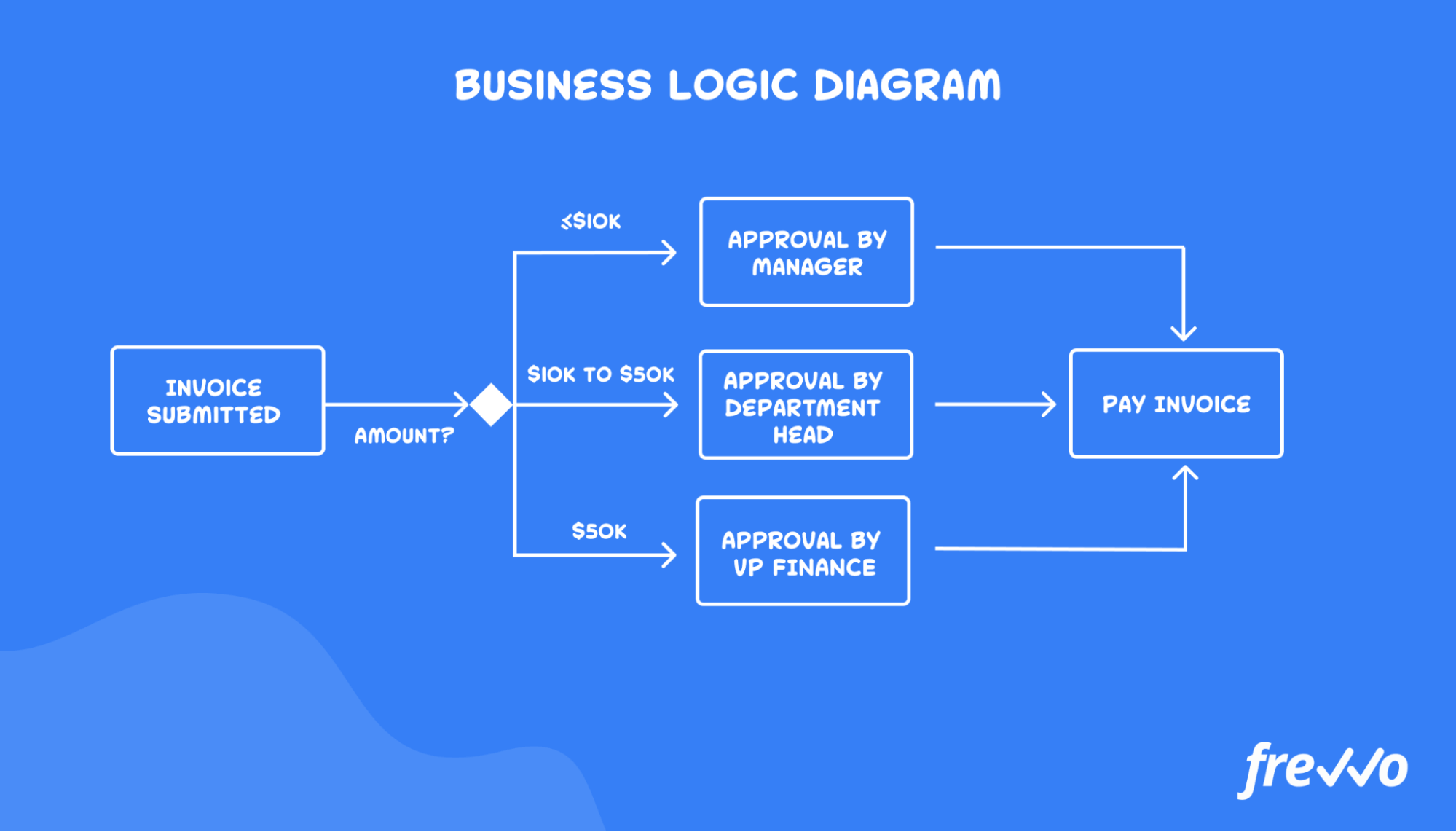

3. Use Business Logic to Automate Complex Payment Authorization Processes

Even if you have a multi-faceted invoice authorization process depending on the amount, you can still automate it successfully. But to do that, you need a solution that can handle complex business logic.

For example, you might follow a process where different people authorize invoices of different sizes.

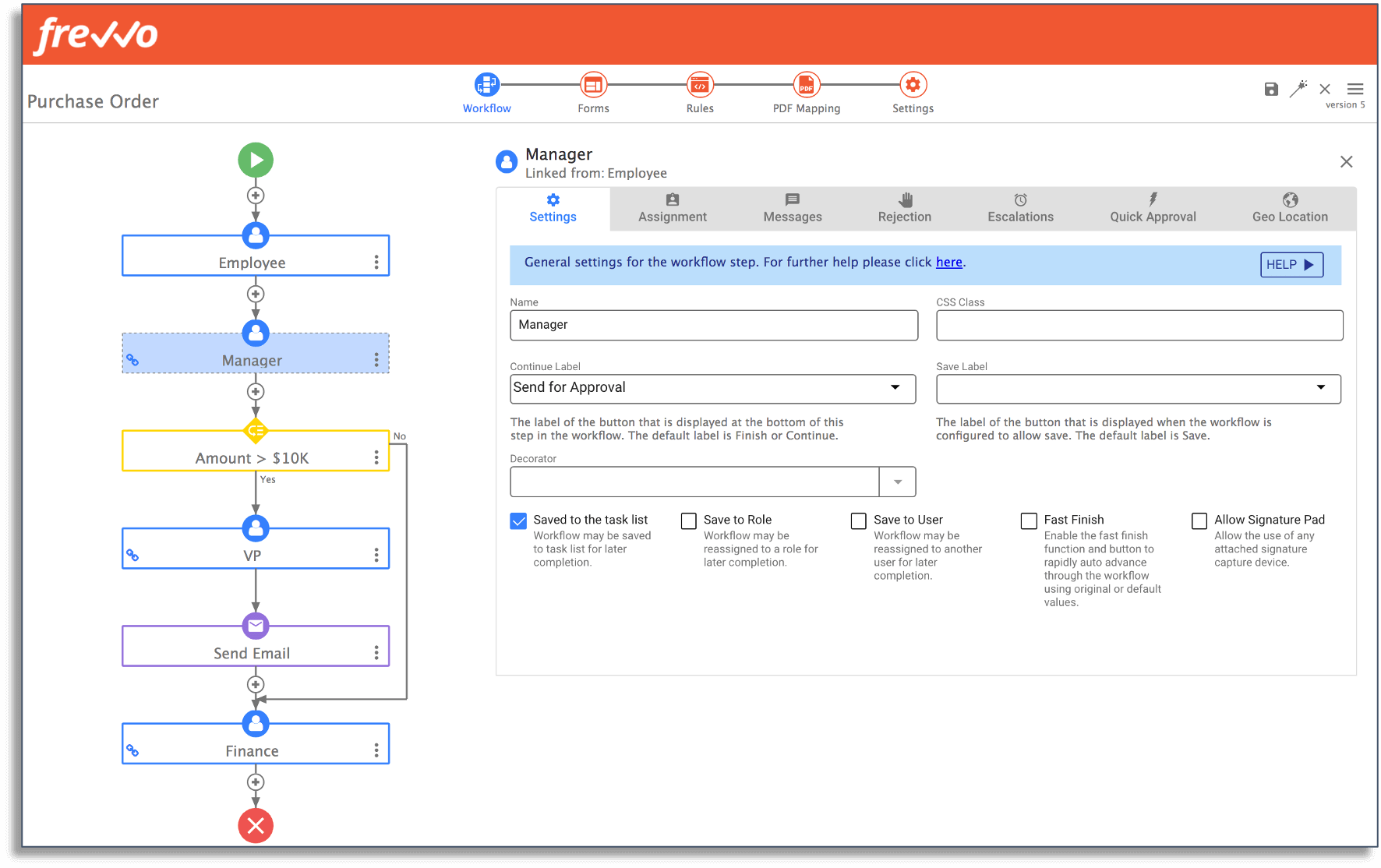

With frevvo, you can easily create a process like this for your purchase orders and invoices with our visual workflow builder.

For example, you can quickly set up rules that will automatically tie in a VP or head of departments to confirm large purchase orders.

You can also create rules based on factors other than price, such as purchase category. If an employee is ordering a marketing video, you can tie in the VP of marketing, not just the head of finance.

frevvo’s forms support authorization with legally binding electronic signatures, which means your team can quickly handle the entire process from start to finish within the platform.

For more tips on how to streamline this process for your vendors, check out our post on best practices for AP automation.

4. Track the Status of All Purchase Orders in Real-Time (And Eliminate Late Payments)

frevvo helps you integrate your invoice approval workflows into your ERP system and ensure your records are up to date.

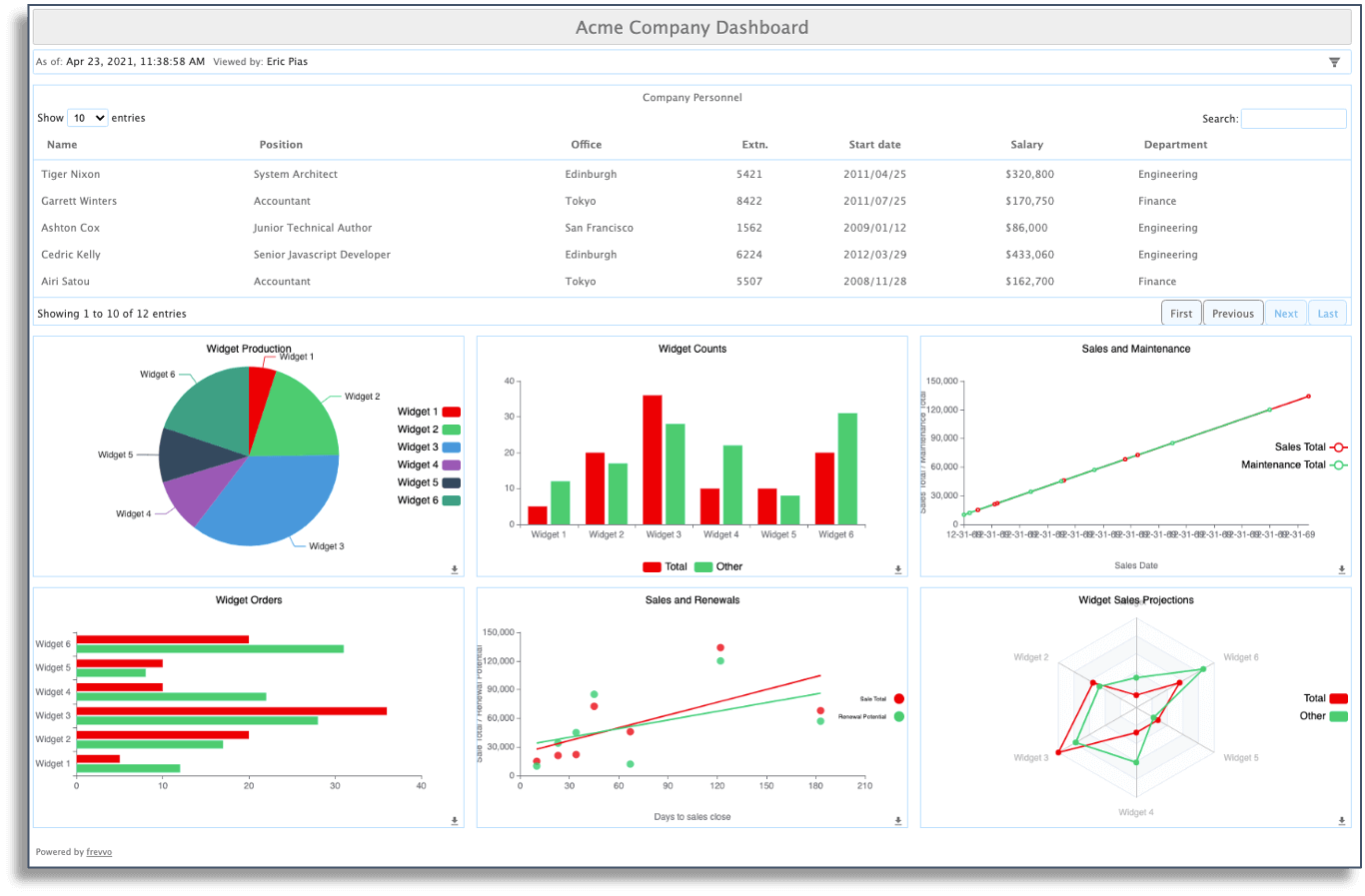

You can even create a custom real-time dashboard that tracks your invoices due and helps you visualize your cash flow.

It may sound complicated, but Central Wyoming University was able to fully automate its purchase order workflow with frevvo in under ten days.

They transformed from a completely paper-based system, struggling with human error and lengthy approval processes, to a smooth automated workflow.

Start Automating Your Accounts Payable Process Today

While most companies already have an accounts payable system in place, they likely face a wide range of challenges, including fraud, delayed payments, and poor supplier relationships.

Unless you want to invest big in developing a custom solution from scratch, a powerful no-code platform like frevvo is key.

With frevvo, you can streamline your accounts payable process from start to finish. You can even automate key elements of your AP process, like invoice authorization, and use digital forms to get rid of manual data entry.

With our drag-and-drop builder, your AP team can set up and control their own processes and digital workspace, ensuring fast adoption and no issues with developer miscommunication. Get started today with a 30-day free trial to set up an entirely new workflow.